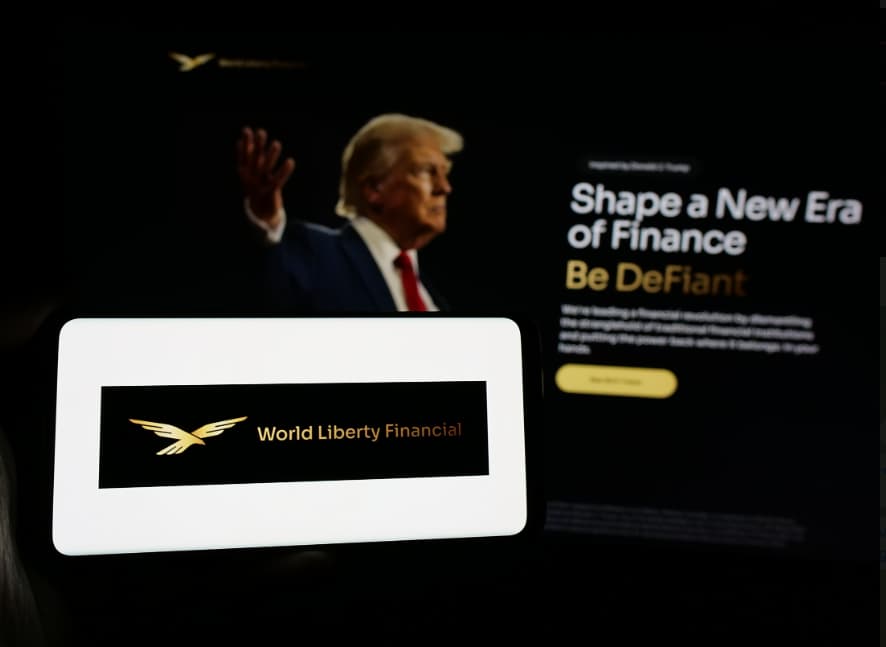

In the fast-paced world of cryptocurrency, staying informed is crucial for investors looking to capitalize on emerging trends and opportunities. One such player making waves in the DeFi space is World Liberty Financial (WLFI), a platform reportedly backed by Donald Trump. Recently, WLFI has enhanced its crypto portfolio with a strategic acquisition of Sei (SEI) tokens, aiming to leverage the burgeoning potential of decentralized finance. This move highlights the importance of diversification and strategic investments in securing financial growth in a volatile market.

World Liberty Financial’s Strategic Investment in Sei (SEI)

WLFI’s recent acquisition of 4.89 million SEI tokens, valued at approximately $775,000, showcases a calculated move in a rapidly evolving market. Conducted through a USDC-backed wallet, this purchase aligns with their history of strategic altcoin investments. According to data from Arkham Intel, SEI experienced a significant rally, soaring over 30% in the past week alone. However, despite these gains, SEI remains down approximately 11% over the past month amid market fluctuations.

WLFI’s Portfolio Performance: Struggles and Signs of Recovery

Despite a promising 13.41% growth in Q1 2025, bringing their cryptocurrency assets from $72.82 million to $82.51 million, WLFI’s broader portfolio still faces challenges. The firm has invested $346.8 million in 11 different cryptocurrencies, but none have yielded profits so far. A significant portion of these losses is attributed to Ethereum (ETH), accounting for over $114 million in unrealized setbacks. Overall, as of April 12, WLFI’s portfolio deficit stands at around $145.8 million, according to Lookonchain.

Nevertheless, recent data from Arkham Intelligence indicates a slight recovery in WLFI’s total holdings, now valued at $102.98 million, marking a modest 0.85% gain. This hints at a potential rebound and underscores the importance of agile portfolio management in the face of market volatility.

Is Sei (SEI) poised for long-term growth?

Sei (SEI) has been gaining traction due to its recent market rally, driven by increased interest in DeFi protocols. Long-term growth potential hinges on its adoption rate, innovative features, and resilience against market fluctuations.

How does World Liberty Financial assess investment risks?

WLFI employs a data-driven approach to evaluate investment risks, utilizing platforms like Arkham Intel to analyze trends and market fluctuations. This strategy helps them make informed decisions and mitigate potential losses.

What impact does market volatility have on cryptocurrency investments?

Market volatility can significantly influence cryptocurrency investments, often leading to rapid price fluctuations. Investors must stay informed and adapt strategies accordingly to manage risks and capitalize on short-term opportunities.

In conclusion, World Liberty Financial’s actions reflect a strategic approach to navigating the complex and often unpredictable world of cryptocurrency investments. By focusing on diversification and informed decision-making, they continue to strive for a balance between risk and reward in their pursuit of financial innovation.