Cryptocurrency continues to capture the global spotlight as pivotal regulatory discussions unfold. In a significant move, members of the US House Financial Services Committee convened to deliberate on reforming digital asset regulations. As digital currencies and decentralized finance (DeFi) grow in prominence, the need for a structured regulatory framework becomes increasingly crucial. Interestingly, this meeting saw the involvement of a notable figure: former US President Donald Trump, whose ventures in cryptocurrency have stirred interest and concern alike. Lawmakers from both political parties seem united in their pursuit of clearer regulations to ensure the stability and legitimacy of cryptocurrency markets.

US Lawmakers Unite for Cryptocurrency Regulation Reform

Political Consensus on Modernizing Crypto Regulations

During the committee session, a rare bipartisan agreement emerged, highlighting a unified stance on the necessity for a coherent regulatory structure for digital assets. This agreement emphasizes that a well-defined framework will not only bolster the crypto industry but also benefit other sectors influenced by blockchain technology. Key witnesses at the hearing criticized the Securities and Exchange Commission’s (SEC) reliance on the Howey Test, arguing it inadequately addresses the complexities of secondary market transactions involving digital currencies.

New Legislative Directions for Digital Assets

A senior lawmaker articulated the collective sentiment, asserting the need to reduce dependency on judicial interpretations to pave the nation’s financial future. This legislative push follows years of regulatory ambiguity faced by companies and investors in the crypto sphere.

Trump’s Cryptocurrency Involvement Sparks Debate

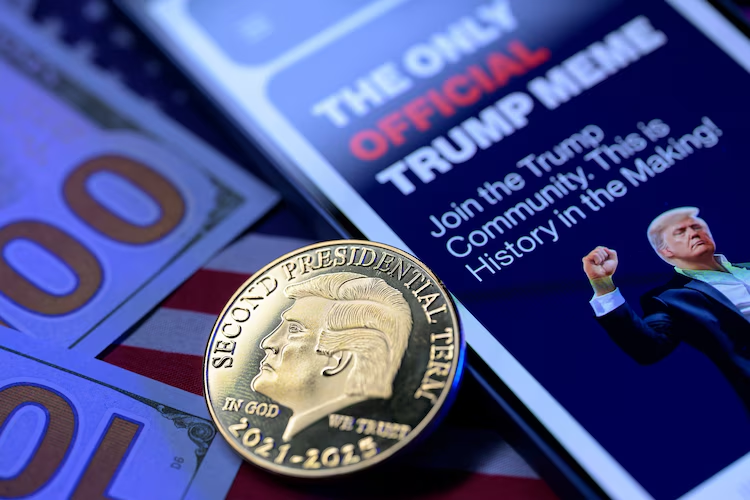

The committee’s mission is complicated by the direct involvement of Trump and his family in the cryptocurrency scene. Reports indicate the Trump family has ties to various crypto ventures, including meme coins and the DeFi initiative World Liberty Financial, which introduced a stablecoin named USD1. These activities have resulted in substantial financial gains, raising concerns about potential conflicts of interest as regulatory policies are debated.

Implications of Presidential Business Interests

President Trump’s investments and projects present a unique challenge, potentially influencing the regulations that his administration helps shape. Some lawmakers acknowledged that these financial ties add complexity to regulatory discussions.

Changing Dynamics with New SEC Leadership

Paul Atkins’ appointment as the new SEC Chair, confirmed by a Senate vote of 52-44, is seen by many pro-crypto lawmakers as a potential pivot point towards more favorable crypto regulations. However, others caution that enduring regulatory clarity will depend more on legislative actions by Congress than on changes in SEC leadership.

Potential Shifts in Cryptocurrency Oversight

Despite optimism, skeptics remain, emphasizing that substantive progress requires concrete legislative measures that outline when digital assets are classified as commodities.

Trump’s Cryptocurrency Projects and Their Market Impact

In the meantime, Trump continues to promote his digital coins as their market release approaches. Scheduled for release on April 17, these tokens represent a significant financial venture, with connections to the Donald J. Trump Revocable Trust as revealed in his 2024 financial disclosure.

Managing Potential Conflicts of Interest

Despite the massive scale of these ventures, the deputy White House press secretary, Anna Kelly, has stated that Trump’s assets are handled by a trust managed by his children, ensuring that no conflicts of interest exist.

FAQs

What is the current stance of US lawmakers on cryptocurrency regulations?

US lawmakers, across party lines, are working towards establishing a coherent regulatory framework for digital assets, aiming to enhance clarity and protect investors while fostering the growth of the crypto industry.

How might Trump’s involvement in cryptocurrency influence regulatory discussions?

Trump’s engagement in cryptocurrency ventures poses potential conflicts of interest, as his financial activities could sway the development and implementation of crypto regulations, complicating the legislative process.

What are the potential impacts of new SEC leadership on crypto regulations?

With Paul Atkins at the helm, there might be a shift towards more pro-crypto policies. However, long-term regulatory clarity will likely depend on legislative efforts by Congress rather than individual leadership changes within the SEC.

This comprehensive guide provides an insight into the evolving regulatory landscape surrounding digital assets, examining the political dynamics, market implications, and unique challenges posed by high-profile involvement in the crypto sector. The FAQs offer additional insights to assist readers in making informed decisions.