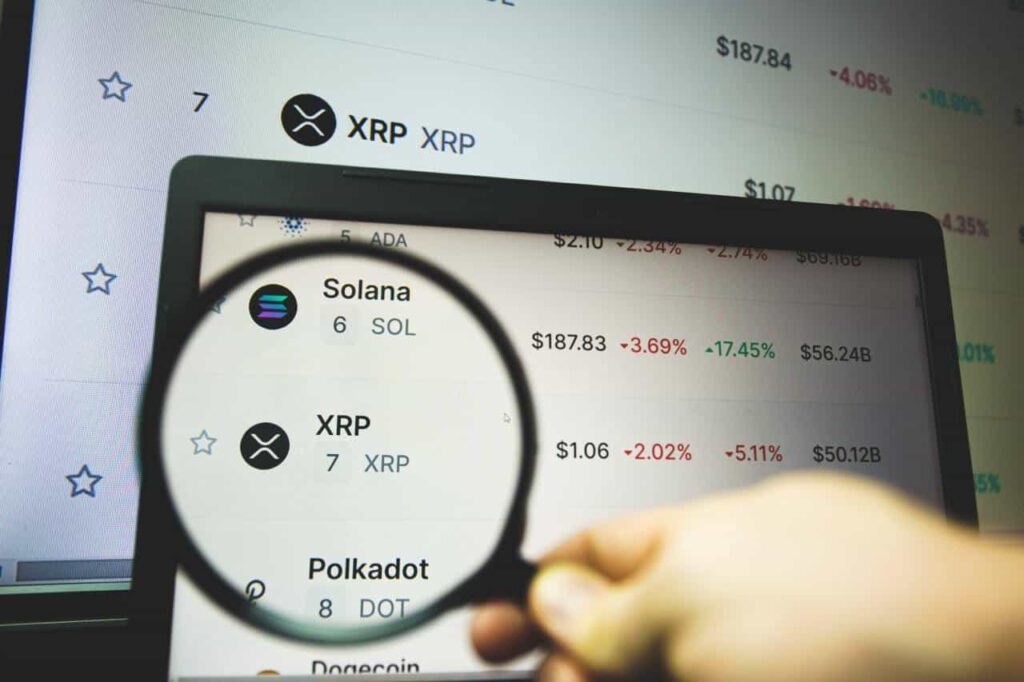

The cryptocurrency world has seen a temporary revival in the fortunes of XRP, which managed to maintain its value above a critical $2 threshold, despite certain technical indicators suggesting a downslide. However, market predictions are not always as black-and-white as they seem – so let’s take a closer look at why.

Understanding the Potential Downswing: A Head-and-Shoulders Pattern in Play

Presently, XRP seems to be presenting a head-and-shoulders pattern. This pattern typically indicates an impending bearish trend. Ali Martinez, a renowned cryptocurrency analyst, explains how the pattern features three peaks, resembling a head and two shoulders. The price spikes and then falls to form the left shoulder, rises again to form the head, and then dips and rises to a lower peak to form the right shoulder. The support level, or the neckline, often warns of a bearish trend when breached.

This pattern on XRP suggests a neckline around $1.90. A breach below this level could warn of a deeper plunge. Consequently, the distance between the head’s peak ($3.20 in this case) and the neckline ($1.90) can give an estimated target for the downside, which in this case falls between $1.10 and $1.20. However, it’s worth keeping in mind that this is just one possible trajectory.

Is a Bullish Breakout Possible for XRP?

Not all the market predictions are gloomy, though. A cryptocurrency analyst operating under the pseudonym Dark Defender has a different perspective. According to a recent post, XRP could be on the verge of a breakout potentially ushering a new all-time high.

Backing this optimistic view, the daily Relative Strength Index (RSI) for XRP recently demonstrated a double-bottom trend, and it seems to be heading towards a golden cross – a bullish indication of an impending upswing. Dark Defender has further highlighted $2.33 as the immediate resistance level and $1.99 as key support. If XRP crosses the $2.33 barrier, it might catapult towards $3.39 or possibly even soar to $5.85 in the short-term.

XRP’s Dependence on External Factors

XRP’s price movements are inextricably linked to the larger cryptocurrency market. Coupled with this, the persisting Securities Exchange Commission (SEC) lawsuit against Ripple, the company associated with XRP, remains a significant unpredictable factor.

In the recent past, the SEC dropped charges against some companies, including Coinbase. But its unwillingness to exonerate Ripple has had a dampening impact on investor sentiment. Moreover, speculations are rife about the SEC potentially settling or dismissing the case eventually, creating an environment of uncertainty.

Additionally, XRP could experience a further boost if the SEC approves spot XRP exchange-traded funds (ETFs), leading to substantial capital inflows. The decision, expected by mid-October, could be a game-changer for the XRP market, which is also bracing itself for the projected release of 1 billion XRP tokens in March.

Present Trading Position of XRP

At this juncture, XRP is being traded at $2.25, marking a 4% increase in the last 24 hours despite a 12% decline over the past week. Even so, the market sentiment tilts towards a bearish outlook, with the token’s price being below the 50-day simple moving average (SMA) of $2.68.

However, XRP is comfortably above the 200-day SMA of $1.51, implying a hopeful longer-term uptrend. With the 14-day RSI positioned at 34.90, XRP might be oversold, and consequently, poised for a bounce-back if buyers rush in again.

FAQs

What is a head-and-shoulders pattern?

A head-and-shoulders pattern is a technical indicator that often signifies a potential bearish trend in the market. It features three price peaks resembling a head and two shoulders.

What could a breach below the $1.90 level mean for XRP?

A breach below the level of $1.90 might signal a substantial downside for XRP, potentially falling to as low as $1.10-$1.20.

How could the SEC lawsuit impact the value of XRP?

The ongoing SEC lawsuit against Ripple presents a significant level of uncertainty. Depending on its outcome, the XRP market could either experience a significant surge or a potential drop.

What is the relevance of the Relative Strength Index (RSI) for XRP?

The Relative Strength Index (RSI) is a technical analysis tool that helps identify if an asset is overbought or oversold. A low RSI (below 30) might indicate that XRP is oversold and could potentially spark a rise in price if buyers decide to step in.