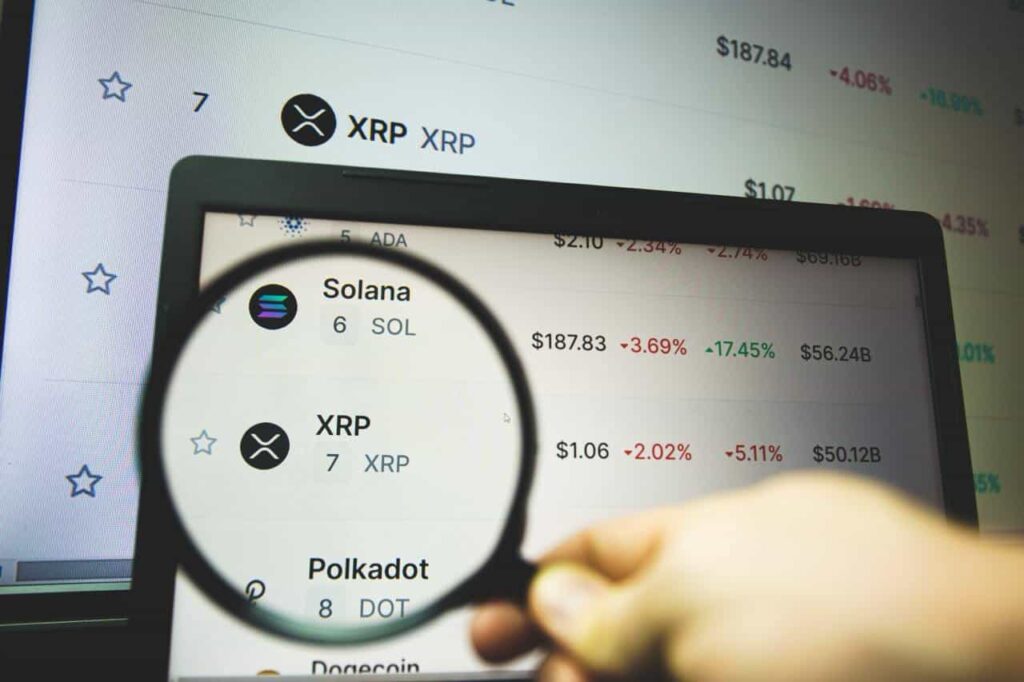

In the world of cryptocurrencies, certain digital coins have demonstrated a resilience that’s hard to ignore. XRP, for instance, has surprisingly stood its ground in spite of the recent crypto market crash that has seen other giants such as Bitcoin (BTC) and Ethereum (ETH) crumble to new lows. Clearly more robust than its counterparts, XRP was still able to hold a 325% rise from its November 1 prices, despite a dip to $2.16—a testament to its strength.

A Pivotal Moment for XRP and the SEC?

One of the significant external factors that appears to be influencing XRP’s performance is the ongoing legal tussle between the SEC and Ripple Labs. It’s an ordeal that has been hanging like a dark cloud over the cryptocurrency.

Recently, the SEC sent out a flurry of notifications to multiple crypto firms, many of which were either a signal that pending charges were being dropped or an indication that no further action would be taken following extensive investigations. Despite several major companies and platforms such as Coinbase and OpenSea receiving these notifications, Ripple was notably left out.

It’s not surprising that many crypto analysts and traders had hoped for a more immediate conclusion to the legal drama after Gary Gensler stepped down from the agency. Following his departure, there was a significant 539.62% rally between November 1 and January 17. The continued state of ambiguity, however, seems to have triggered XRP’s decline post the January 20 inauguration of Donald Trump. As of the end of February, it appears the market is in a holding pattern, refraining from major buying or selling activity as they anticipate the SEC’s impending decision.

Fate Of XRP Traders in Balance?

In the midst of the regulatory uncertainty, XRP could be facing a pivotal moment on the horizon. This is due to the planned unlocking of 1 billion tokens scheduled for March 1, which is expected to result in a significant shift in the XRP market.

Apart from the immediate fluctuations and regulatory suspense, technical analysis suggests that XRP could potentially see a drop towards $1.60 in the near future. However, as recently as February 27, there was also a case for a rally towards, and possibly beyond, $3.

Staying Updated with Finances Zippy

For those keen on keeping a close watch on the future trajectory of XRP, leveraging a top-tier cryptocurrency application such as Finances Zippy can prove quite beneficial. It offers insightful price predictions and market trends that could greatly assist in making informed decisions.

## FAQs

### What is influencing XRP’s current performance?

The ongoing legal battle between the SEC and Ripple Labs seems to be a significant factor influencing XRP’s financial performance. The crypto market is awaiting the SEC’s decision, and this anticipation reflects in XRP’s recent performance.

### What could happen to XRP on March 1?

There is a planned unlocking of 1 billion tokens scheduled for March 1. This significant event could cause a drastic change in the XRP market, potentially inciting major buying or selling activity.

### How can I track future trends of XRP?

A leading cryptocurrency application such as Finances Zippy can provide insightful data such as price predictions and market trends, aiding in keeping track of potential future movements of XRP.

In conclusion, it’s clear that the tides of the cryptocurrency market are always shifting. They remain heavily influenced by external factors, the decisions of regulatory bodies, and market sentiments. As we move forward, keeping a close eye on these developments will be critical to navigating these digital seas. And with tools like Finances Zippy, tracking such trends and making informed choices could be significantly easier.