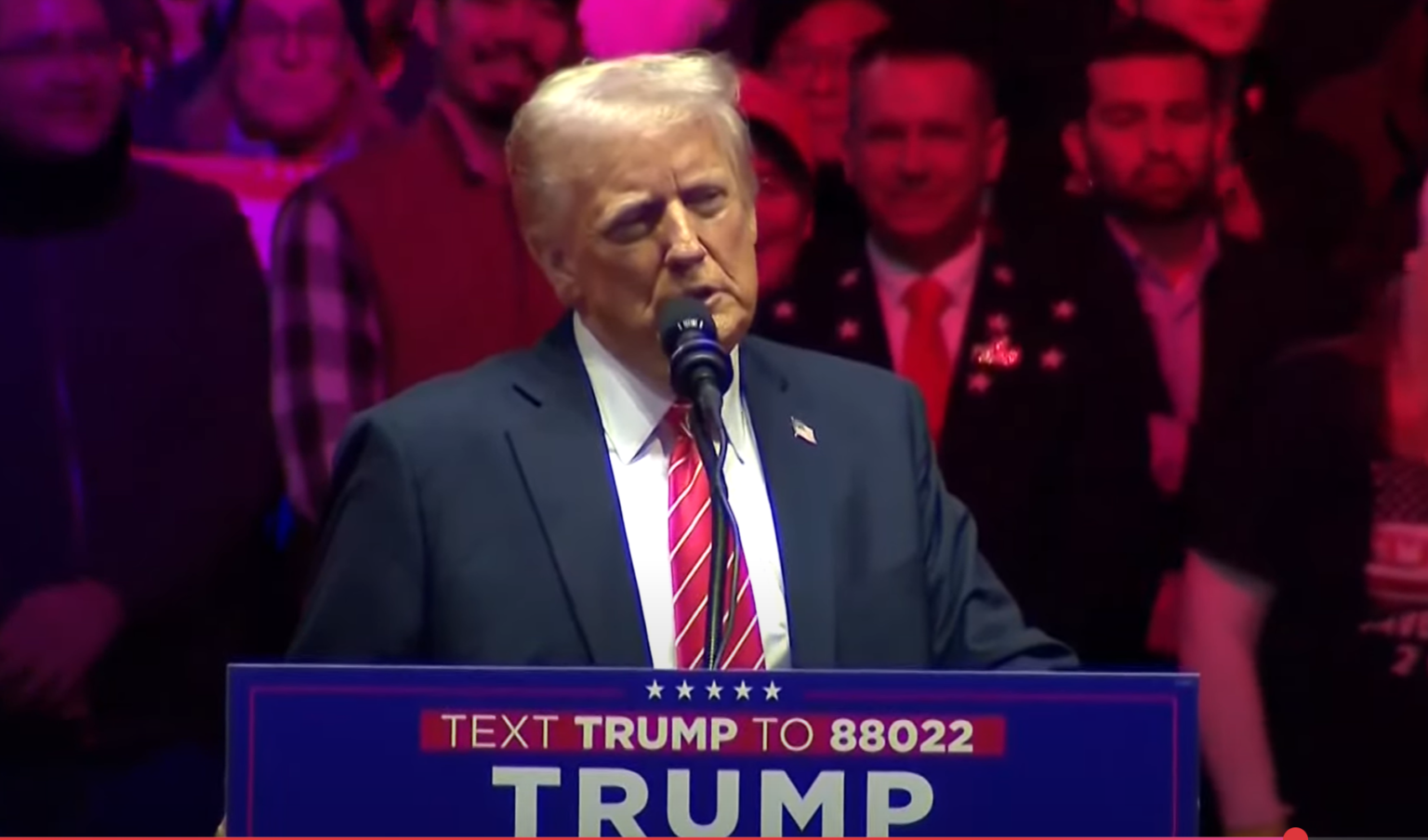

Picture this: Donald Trump, once holding an estimated 1% of his fortune in digital assets, now reportedly holds over 90% of his wealth in cryptocurrency. This shocking revelation has ignited a firestorm of discussion across various online platforms, with influential tech leader and former Coinbase CTO, Balaji Srinivasan, joining the conversation to discuss the potential global outcomes.

Deciphering The TRUMP Memecoin’s Impact on Crypto

Srinivasan communicated his belief that Trump’s massive shift into cryptocurrency could be a sign of things to come. He suggested that the phenomenon of traditional assets quickly becoming outshined by digital holdings could soon become widespread as fiat dwindles. Leveraging his substantial audience and political clout, Trump could find himself in a favorable position within the cryptocurrency world. Srinivasan argued that the fascination with this unexpected rise could encourage influential figures worldwide to observe and potentially follow suit.

Srinivasan moved on to hypothesize that if personal memecoins continue to increase, investors would be aware that they’re primarily investing in a personal brand’s potential future value. Considering whether a token branded after Trump could survive the volatility which commonly contributes to the downfall of many celebrity tokens, Srinivasan highlighted factors like Trump’s ‘presidential immunity’ and vast following as potential stabilizing elements.

Future Implications and Potential Backlash

According to Srinivasan, the negative reactions this move might stir up from Washington could prompt the upcoming US president to engage aggressively on social media. The incentives of protecting his digital wealth could naturally align with advocating for crypto-friendly regulatory frameworks. Srinivasan also speculated that Trump’s strategy of transparency could be a possible response to accusations of conflicts of interest, setting him apart from other politicians and high-profile individuals who’ve been accused of profiting discreetly.

However, transparency alone may not completely quell apprehensions about whether Trump’s obligations as a political figure might conflict with his digital assets’ performance. Srinivasan drew a comparison between a corporation’s CEO and a head of state, explaining that alignment of interests is crucial. Srinivasan further ventured that ideally, a national cryptocurrency could ensure alignment between a president’s holdings and those of the regular citizens.

Pioneering Distribution of Digital Tokens

The speculation then transitioned to the possibility of Trump distributing tokens to the general public. This potential distribution of ‘TRUMP’ tokens to every US citizen or his supporters would be a first of its kind and would inevitably test legal boundaries. If the current valuations hold, Trump could distribute an equivalent of one hundred dollars’ worth of TRUMP to all seventy-seven million of his voters, potentially leading to a significant expansion of his political brand.

Srinivasan proposed that such a move could potentially disrupt existing patronage structures within the American political landscape, particularly the Democratic party’s structure, by providing an incentive for individuals to support pro-crypto policies in return for something akin to universal basic income. This would foster a new kind of personal relationship between the president and citizens.

FAQs

What are crypto-assets?

Crypto-assets, also known as cryptocurrencies, are digital representations of value or contractual rights that can be transferred, stored or traded electronically.

What is a memecoin?

A memecoin is a type of cryptocurrency that has gained popularity through social media platforms, often spurred by a meme or trending topic.

What are the potential risks and benefits of investing in cryptocurrency?

Cryptocurrency investments can offer high returns, but they also come with high risks, including volatility, lack of regulation, and cybersecurity threats. It’s essential to conduct thorough research and consider potential risks before investing.

What factors can influence cryptocurrency prices?

Cryptocurrency prices can be influenced by various factors, including supply and demand, market sentiments, technological advancements, regulatory news, and macroeconomic trends.

At the time of writing, the much-debated TRUMP memecoin is valued at $58.00. This emerging story underscores the evolving interplay between politics and cryptocurrency, suggesting intriguing possibilities for their combined future. Regardless of individual sentiments towards the TRUMP memecoin or the man himself, there is no denying the potentially transformative impact of this development on future political and economic landscapes.