In the dynamic world of cryptocurrency, the XDC Network is making waves by spearheading a significant surge in the adoption of USDC. This growth phase is among the most prolific since the introduction of native USDC on this blockchain. As cryptocurrency enthusiasts and investors alike seek platforms that promise security, scalability, and efficiency, understanding the XDC Network’s role in stablecoin liquidity is crucial.

Understanding XDC Network’s USDC Growth Surge

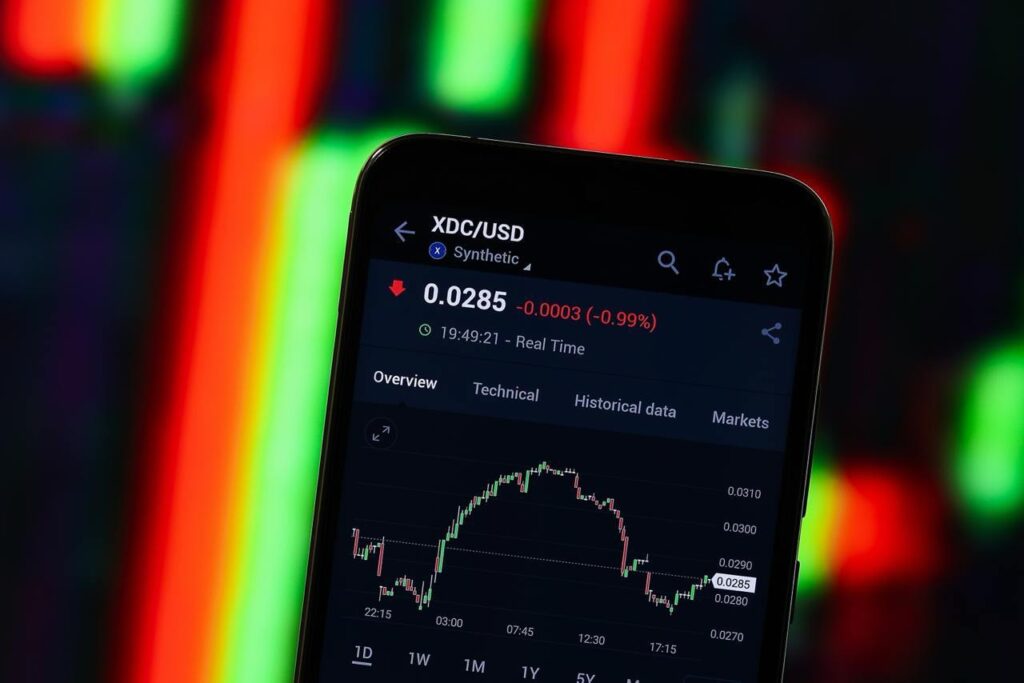

The XDC Network’s recent momentum underscores its position as a pivotal player in the cryptocurrency landscape, particularly in stablecoin deployment. According to independent analytics from Token Terminal, USDC’s growth on the XDC Network ranks as the second fastest among stablecoin deployments worldwide over the past month. This rapid expansion highlights XDC’s capability as a robust settlement network and sets a precedent for its continued influence in the digital finance space.

XDC’s Approach to Stablecoin Liquidity

As digital transactions become more prevalent, stablecoin liquidity is increasingly favoring networks designed for cost-effectiveness and scalability. XDC stands out by offering ultra-low transaction fees, rapid settlement times, and an energy-efficient Proof-of-Stake infrastructure, making it an attractive alternative to blockchain networks with higher fees. Additionally, XDC is enhancing its cross-chain capacities through Circle’s CCTP, further cementing its reputation as a foundational layer for next-gen digital finance.

Exchange Support and Market Adoption

XDC’s growing influence is further supported by an expanding network of global exchanges. Platforms like Bybit, KuCoin, MEXC, Bitrue, Gate.io, and Private Maxi have implemented native USDC on the XDC Network. This widespread exchange integration facilitates seamless transactions, thus driving liquidity and providing greater market access for market makers, OTC desks, and enterprise payment solutions exploring cost-effective alternatives to traditional blockchain networks.

The increase in USDC’s presence on XDC isn’t mere integration; it’s a testament to genuine usage and substantial capital inflows. The network efficiently processes transactions at minimal costs, enhancing its appeal across the financial landscape.

Insights from Industry Experts

Angus O’Callaghan, Head of Trading and Markets at XDC Network, remarked, “With multiple exchanges going live and USDC liquidity scaling quickly, XDC is proving itself as a credible, efficient, and enterprise-ready environment for stablecoin movement.” This growth showcases increasing market confidence in XDC’s infrastructure and its potential to support institutional-grade settlements.

What’s Next for XDC Network?

The ongoing adoption of USDC sets the stage for the XDC Network’s further expansion. Future plans include new exchange integrations, partnerships for secure custody solutions, ecosystem liquidity initiatives, and consistent transparency concerning USDC market activities. These efforts mark a pivotal milestone in XDC’s mission to fortify real-world financial infrastructure.

FAQs About XDC Network and USDC

How does the XDC Network ensure efficient transactions?

The XDC Network leverages a Proof-of-Stake consensus mechanism, allowing it to offer ultra-low transaction fees and fast settlement times, making it an optimal choice for stablecoin and digital transactions.

What makes XDC Network’s ecosystem attractive to exchanges?

XDC provides a seamless integration process, low operating costs, and enhances cross-chain capabilities, which are critical factors for exchanges seeking robust, scalable blockchain solutions.

Is investing in USDC on the XDC Network a wise decision?

Investing in USDC on the XDC Network could be beneficial due to its rapid market adoption and network efficiency. However, like all investments, it is vital to consider market trends, technological updates, and personal financial goals.

The XDC Network’s evolving role in stablecoin settlement signifies a major step forward in its broader journey toward transforming financial infrastructure globally. As this network continues to grow and innovate, it remains an attractive option for individuals and enterprises looking to engage in secure, efficient digital finance.