In the ever-evolving world of cryptocurrencies, understanding market patterns can be key to gaining an edge. Every year, certain months seem to align with distinct trends, and November has consistently stood out as one of the most notable for Bitcoin. Historically perceived as a time of robust growth, November has often heralded significant rallies leading to new all-time highs. Following a lackluster October, where Bitcoin dipped by approximately 11%, the market mood remains surprisingly upbeat. Analysts are observing signs of recovery, increased institutional investments, and renewed corporate interest. In such a landscape, November emerges as a potential growth window, with innovative projects like Bitcoin Hyper set to ride the wave of this momentum.

The Significance of November: A Historical Overview

The Influence of Seasonality and Historical Trends

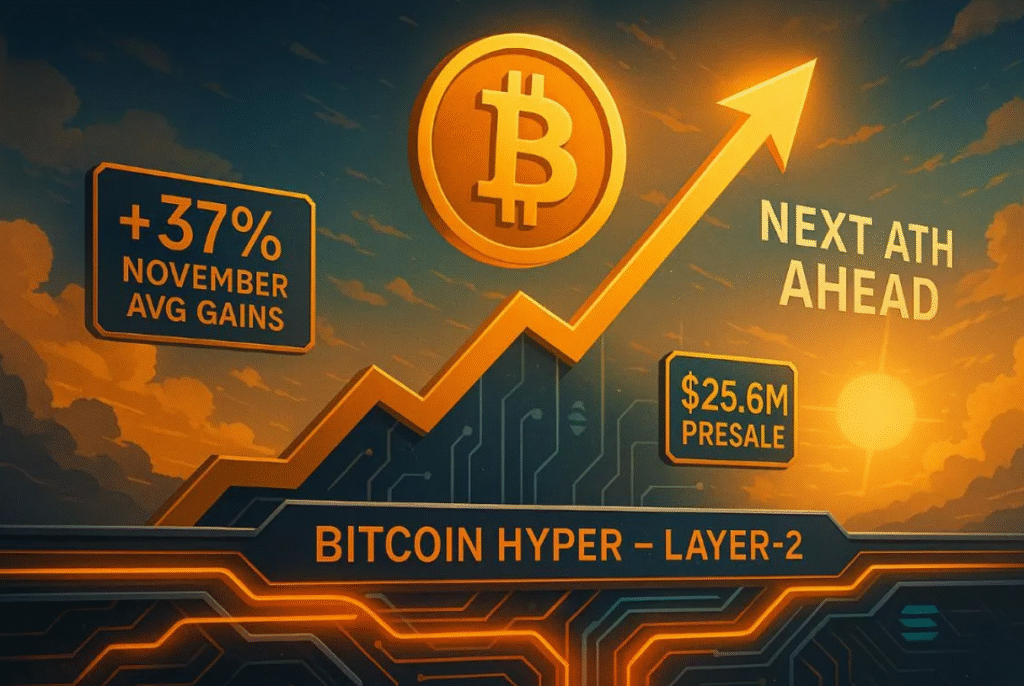

Over the past decade, November has consistently exhibited a positive trajectory for Bitcoin, with average gains around 30% during bull markets. In standout years like 2017 and 2020, Bitcoin recorded November surges of 53% and 42%, respectively, sparking new growth cycles. Similarly, in 2024, after a prolonged consolidation phase, November witnessed a 47% rally, driven by increased trading volumes and renewed investor confidence. While these historical trends do not guarantee future outcomes, they provide valuable insights into why traders remain optimistic. In the volatile world of cryptocurrency, collective psychology plays a pivotal role, and seasonal patterns often bolster bullish narratives.

The Emerging Role of Bitcoin Hyper

Bitcoin Hyper is an emerging project designed to enhance Bitcoin’s capabilities through a scalable Layer-2 network. Its ambitious goal is to make Bitcoin faster, more cost-effective, and suitable for everyday use, without compromising the main blockchain’s security. While Bitcoin continues to be viewed primarily as “digital gold”—a store of value—it is not yet widely recognized as an efficient medium of exchange. Bitcoin Hyper aims to shift this perception, offering near-instant transactions and enabling decentralized applications, such as DeFi protocols and tokenized asset platforms. In this sense, the project represents a possible natural evolution of the Bitcoin ecosystem, moving towards broader adoption.

The Combined Effect of Institutional Inflows and Innovation

Positive sentiment in the market is not solely driven by seasonal statistics. Institutional inflows into Bitcoin spot ETFs and derivative products have reached new heights, indicating a growing interest from larger, more stable investors. Corporate treasuries are also revisiting Bitcoin as a diversification tool amid macroeconomic uncertainties. Simultaneously, the rise of projects extending Bitcoin’s functionality—like the Lightning Network or Bitcoin Hyper—creates a “chain reaction,” reinforcing the perception of an expanding ecosystem. When the market senses that the core network is evolving, the sector tends to react enthusiastically, with investors seeking exposure to the most innovative solutions.

Risks and Considerations

However, it’s crucial to maintain a realistic outlook. The cryptocurrency market remains volatile, and the idea that November will always yield positive results is a trend, not a rule. Macroeconomic risks, such as high interest rates or regulatory crackdowns in certain countries, can still impact prices. Although Bitcoin Hyper is promising, it is a new project that must prove its robustness, network security, and practical value for users and developers. In a sector where many initiatives fade post-hype, the natural selection of projects is inevitable, with only the most solid enduring the long haul.

Conclusion

Should history repeat itself, November might once again be a pivotal month for Bitcoin. Increasing confidence, institutional capital inflow, and focus on innovative projects like Bitcoin Hyper point to a market that is not just growing, but evolving. Nevertheless, caution remains essential: enthusiasm can be a powerful driver, but it does not replace the rational assessment of risk. For investors and enthusiasts, this November presents a month of both opportunity and testing, where Bitcoin might reaffirm its foundational role in the evolving crypto landscape.

Is Bitcoin always expected to rise in November?

While historical data suggests that Bitcoin has performed well in November, it is important to note that past performance does not guarantee future results. Market conditions can vary significantly due to various macroeconomic factors.

How does Bitcoin Hyper aim to improve Bitcoin’s functionality?

Bitcoin Hyper seeks to enhance Bitcoin by using a scalable Layer-2 solution that facilitates faster and cheaper transactions. It also aims to enable decentralized applications, broadening Bitcoin’s use cases beyond merely being a store of value.

What are the risks associated with investing in cryptocurrency during historically bullish months?

Investing in cryptocurrency during historically bullish months like November carries risks, including market volatility, regulatory changes, and broader economic factors that can affect price movements. It’s crucial for investors to conduct thorough research and consider their risk tolerance.