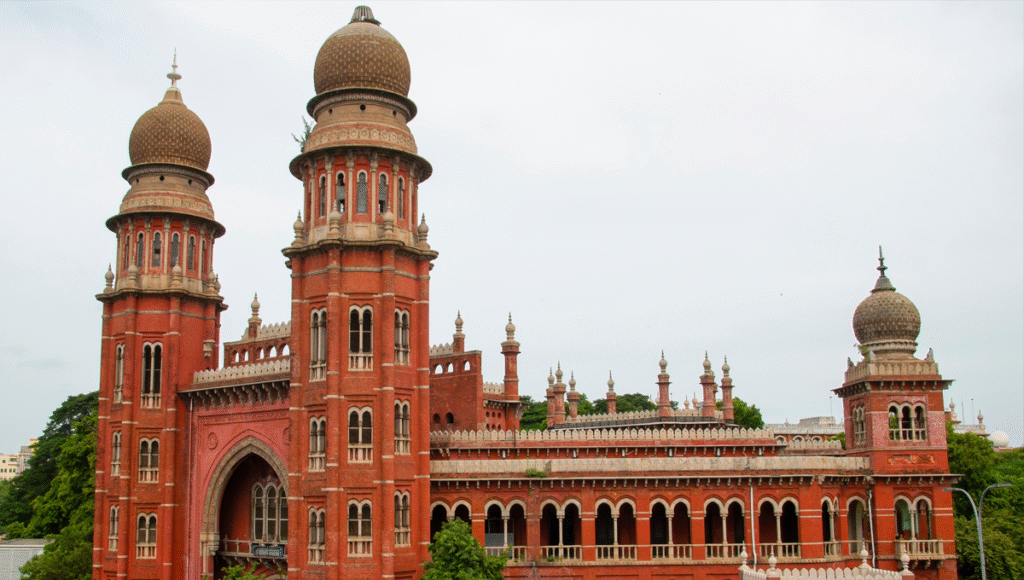

The evolving legal landscape surrounding cryptocurrencies is shaping how these assets are perceived and managed globally. In a landmark decision, the Madras High Court has recognized cryptocurrencies as a form of property. This ruling not only provides a legal framework for crypto holders but could also impact how exchanges operate, especially in the context of security breaches or hacks. Understanding the implications of this decision is crucial for both individual investors and the wider financial industry.

Understanding the Legal Recognition of Cryptocurrencies as Property

Legal Framework: Cryptocurrencies Defined as Property

The Madras High Court has set a precedent by classifying cryptocurrencies as a form of property. This judgment acknowledges that these digital assets possess attributes similar to traditional forms of property, such as ownership, transferability, and control through private keys. According to Justice N. Anand Venkatesh, cryptocurrencies can be held “in trust,” signifying their recognition as a legal asset class. This decision draws from definitions within the Income Tax Act, particularly under Section 2(47A), which addresses “virtual digital assets.”

The WazirX Hack and Legal Protection of Holdings

In a significant case involving the cryptocurrency exchange WazirX, a security breach on July 18, 2024, resulted in the theft of approximately $230 million in Ethereum and ERC-20 tokens. Amid this cybersecurity incident, an affected user, who owned 3,532 XRP valued at around ₹1.98 lakh as of January 2024, sought legal intervention to safeguard her coins from being included in a communal compensation pool for the stolen assets. The court ruled in favor of protecting her XRP, underscoring the distinction between individual holdings and those compromised by the breach.

Jurisdiction and Arbitration Challenges

Despite WazirX advocating for arbitration in Singapore, as per their user agreements, the Madras High Court asserted jurisdiction over the case. The rationale was the transactions’ ties to India, with funds originating from Indian bank accounts and the exchange’s registration within the country. Consequently, the court mandated ad-interim relief, preventing the user’s XRP from being reallocated as part of the hack’s compensatory measures.

Implications for Crypto Users and Exchanges

This court decision enhances the legal recourse available to crypto users, empowering them to contest exchanges in Indian courts over potential mismanagement or exploitation of their funds. For exchanges, this ruling could lead to more stringent requirements for record-keeping, clear segregation of client funds, and improved audit trails. Notably, judges emphasized the technical attributes of cryptocurrencies, such as their transferability, identifiability, and exclusive control, all of which substantiate the recognition of legal ownership.

Upcoming Tax and Legal Implications

The recognition of cryptocurrencies as property may align with existing tax regulations that categorize virtual assets similarly, potentially influencing the taxation of gains and transfers in the future. While the judgment is authoritative, it remains open to appeals and scrutiny by higher courts. This case specifically protects the XRP holdings mentioned, yet it could trigger further legal debates concerning other tokens and users.

Are cryptocurrencies subject to property laws in other jurisdictions?

Cryptocurrency recognition as property varies by jurisdiction. Some countries have recognized digital assets as property, while others are still developing legal frameworks. The recognition often affects taxation, estate planning, and trading regulations, necessitating awareness of local laws.

What are the implications of treating crypto as property for taxation?

Treating cryptocurrencies as property typically subjects them to capital gains tax upon sale or transfer. This classification can also affect how crypto is reported for income tax purposes, impacting investors and traders who must comply with existing tax codes.

How can investors safeguard their crypto holdings after hacks?

Investors can enhance security by using hardware wallets, enabling two-factor authentication, and regularly updating their software. Engaging with platforms that have strong security protocols and clear compensation policies can also minimize potential risks associated with hacks.

This comprehensive guide explores the intricacies of legal decisions surrounding cryptocurrencies, highlighting their implications for investors and exchanges alike. By understanding these dynamics, individuals can make more informed decisions regarding their digital assets.