The integration of blockchain technology within traditional financial systems is transforming how money moves globally. A recent announcement from one of the world’s leading remittance companies, Western Union, highlights this transformative journey into the realm of cryptocurrency. By exploring stablecoin-based solutions, Western Union is embracing digital assets to enhance its services, providing faster and more transparent transactions. This strategic move not only reflects a significant shift in the financial landscape but also showcases the potential of cryptocurrencies like stablecoins to revolutionize financial services, offering customers more choices and control over their money.

Western Union’s Dive into Stablecoin-Powered Remittances

Unlocking New Opportunities with Blockchain

In a recent earnings call, Western Union’s CEO, Devin McGranahan, announced the company’s pilot program to integrate stablecoin-based settlement rails. This initiative marks a pivotal moment, as the global remittance leader aims to redefine cross-border payments by leveraging the efficiency of blockchain technology. Highlighting the company’s commitment to customer choice and control, McGranahan stated, “This is not about speculation. It is about giving our customers more choice and control in how they manage and move their money.”

Western Union currently processes approximately 70 million transactions each quarter, catering to over 150 million customers worldwide across more than 200 countries. Despite its lengthy reliance on traditional correspondent banking networks, known for being costly and opaque, the company recognizes the need for innovation to maintain its competitive edge. By piloting a stablecoin settlement system, Western Union seeks to reduce transaction windows, minimize costs, and enhance transparency.

A Regulatory Landscape Favoring Innovation

Western Union’s previous hesitance toward cryptocurrency adoption was primarily due to concerns over volatility and regulatory clarity. However, the passage of the US GENIUS Act is a game-changer. This Act provides a robust framework for stablecoin issuers, demanding 1:1 fiat-backing, regular audits, and access to Federal Reserve accounts. These measures create a stable and transparent environment, encouraging financial giants like Western Union to embrace blockchain.

Stablecoins offer distinct advantages for users, particularly in countries with high inflation. Holding assets denominated in US dollars provides financial stability and autonomy, transcending basic transactional efficiency. These benefits align with the empowering ethos of stablecoins, paralleling the offerings of the Best Wallet ecosystem and its associated utility token, $BEST.

The Rise of Best Wallet Token ($BEST)

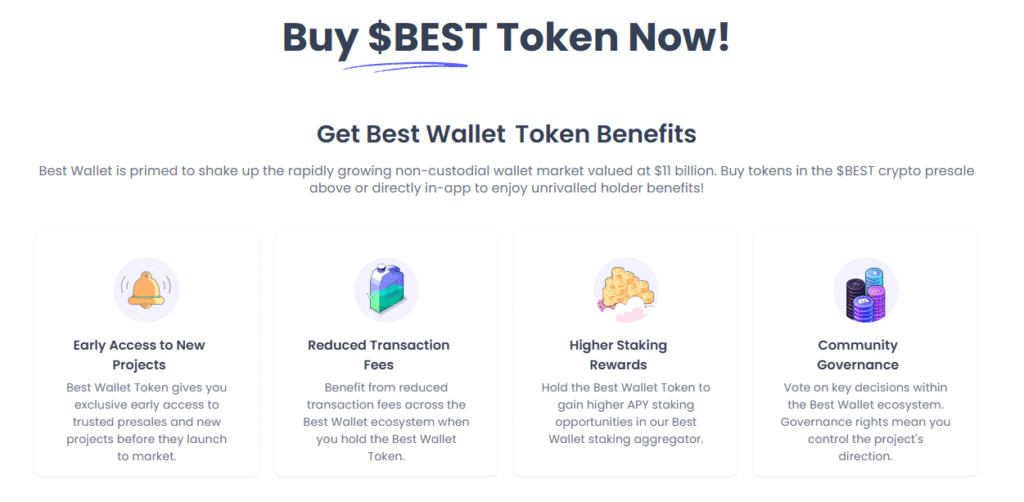

The Best Wallet Token ($BEST) serves as a cornerstone in the Best Wallet ecosystem. This innovative Web3 financial platform simplifies crypto management, offering users a seamless gateway to decentralized finance (DeFi). Best Wallet boasts features such as multi-chain and multi-wallet support, advanced security via multi-party computation (MPC) and biometrics, and direct DeFi access.

$BEST enhances the platform’s functionality by increasing staking rewards, offering exclusive presale access, and reducing transaction fees. Investors show significant interest in $BEST, evidenced by its successful presale, which has raised over $16.6 million. With tokens priced at $0.025855, the ecosystem expects potential gains to reach 2,297% by the end of 2026, drawing considerable investor attention.

How does Western Union’s stablecoin pilot affect global remittances?

Western Union’s stablecoin pilot aims to revolutionize global remittances by drastically reducing transaction times and costs while providing increased transparency. This shift could significantly impact how cross-border payments are conducted, offering customers more efficient and secure services.

What is the US GENIUS Act, and how does it support stablecoin adoption?

The US GENIUS Act establishes regulatory clarity for stablecoins by mandating fiat-backing, regular audits, and access to Federal Reserve accounts. This framework supports stablecoin adoption by ensuring stability and transparency, encouraging financial institutions to integrate these digital assets into their services.

What makes the Best Wallet Token ($BEST) attractive to investors?

$BEST is appealing due to its utility within the Best Wallet ecosystem, offering features like enhanced staking rewards, reduced transaction fees, and exclusive presale access. Its successful presale and potential for substantial future gains further solidify its attractiveness to investors.

As Western Union embraces stablecoin technology and enhances its financial offerings, the potential for transformation within the global remittance market is profound. By integrating blockchain technology, the company sets the stage for a more efficient and transparent future, paving the way for further innovation in the financial ecosystem.