In the ever-evolving landscape of cryptocurrencies, the signals of a new token launch can send ripples across the market. Shayne Coplan, noted for his influence in the crypto space, recently sparked curiosity and speculation with a cryptic social media post hinting at the potential introduction of a new token associated with Polymarket. As the industry anticipates further developments, the implications of such a move could be significant, given Polymarket’s unique position in event-based prediction markets.

Polymarket’s Potential Token Launch: What It Could Mean for the Market

The Anticipation of Polymarket’s New Token

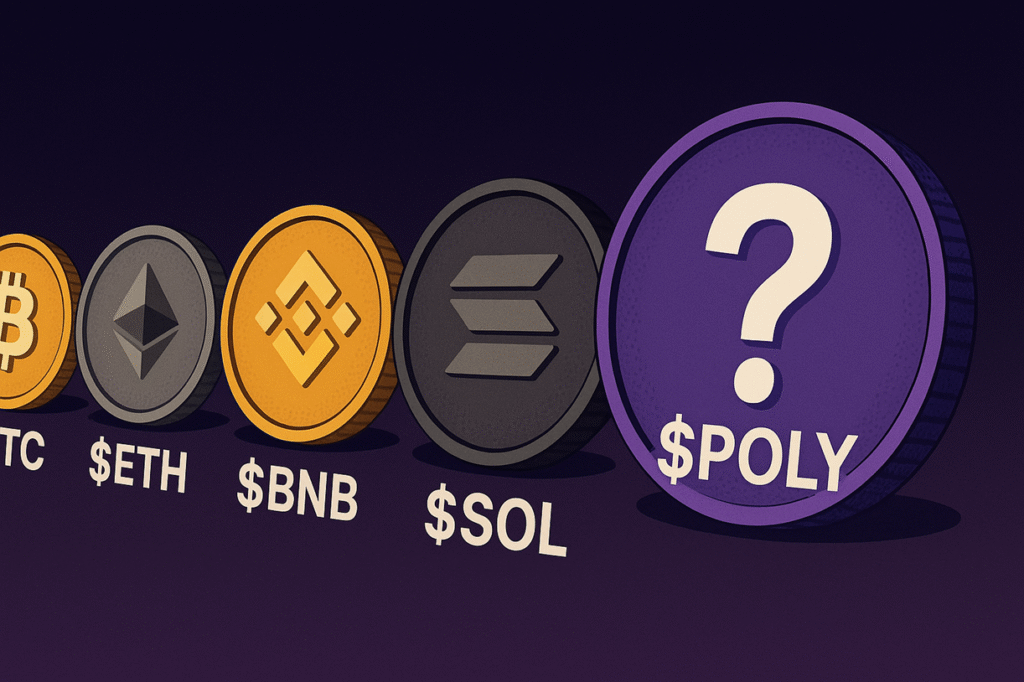

Shayne Coplan, the founder of Polymarket and recently spotlighted by Bloomberg as the youngest self-made billionaire on its Billionaires Index, has begun stirring speculation about Polymarket potentially launching its native token. His recent post on platform X, featuring “$BTC $ETH $BNB $SOL $POLY 🤔”, has led to discussions about the emergence of a new asset within Polymarket, a platform celebrated for its innovative approach to event markets.

While the discussion is vibrant, the details about this potential token remain under wraps. The mention of “$POLY” alongside established giants like Bitcoin and Ethereum has caught the attention of traders and analysts alike, prompting expectations of a possible user distribution similar to other crypto platforms undergoing decentralization.

The Strategic Context Behind Polymarket’s Moves

The timing of this teaser coincides with a notable financial development. The Intercontinental Exchange (ICE), which owns the New York Stock Exchange, has committed to a strategic investment in Polymarket, valuing the company at approximately $8 billion pre-money. This move underscores a growing institutional interest in data-driven event markets, positioning Polymarket as a significant player in this niche.

However, Polymarket’s journey has been complex. In 2022, it faced regulatory setbacks when the Commodity Futures Trading Commission imposed fines for facilitating unregistered binary options, prompting the company to reevaluate its market offerings while bolstering its compliance measures. Despite these challenges, Polymarket has remained relevant through high-profile political and sporting events. Given this backdrop, any steps toward token issuance would likely entail meticulous planning to address regulatory concerns and foster community governance.

Speculations on Potential Airdrop Impact

The potential launch of a Polymarket token has sparked discussions about its possible impact on the crypto market. As of now, Solana’s market capitalization is around $124-125 billion, placing it below XRP and BNB. A token launch by Polymarket could aim to position itself within the top market slots, prompting comparisons with past successful airdrops, such as Arbitrum’s, which achieved a day-one valuation of around $1.6 billion.

Should Polymarket proceed with a token launch, the benchmarks set by previous airdrops would serve as pivotal points of comparison. The market continues to watch closely, with keen interest in how Polymarket will navigate these waters amidst its regulatory history and robust backing.

How Will Polymarket Ensure Regulatory Compliance?

Given its past regulatory challenges, Polymarket is likely to prioritize compliance in any token issuance. Strategies may include close collaboration with legal advisors, to ensure adherence to financial regulations and prevent future infractions.

What Makes a Token Launch by Polymarket Significant?

A potential token from Polymarket could alter the dynamics of event-driven markets, attracting more participants and potentially increasing liquidity. Its strategic positioning and partnerships, like that with ICE, highlight its potential to institutionalize such markets.

Could POLY Surpass Previous Airdrop Records?

The impact of a POLY token airdrop would depend heavily on its initial distribution strategy and the market’s reception. While Arbitrum’s airdrop sets a high bar, POLY could potentially eclipse it if it leverages Polymarket’s existing user base and strategic partnerships effectively.

This guide navigates the potential implications of a Polymarket token, offering insights into its strategic relevance and exploring the market’s anticipation of such a development. The FAQs provide additional perspectives to assist readers in understanding the broader financial and technological impact of this potential launch.