In the ever-evolving landscape of digital finance, XRP remains a dynamic player despite recent fluctuations. As of the first week of October, XRP encountered resistance at the $3 mark but held on to a market capitalization north of $179 billion. This places it in a competitive position even though it fell short of being among the weekly top gainers. Intriguingly, XRP briefly surpassed the value of large entities like BlackRock, showcasing its potential for sudden upward movement. This guide delves into the current trends influencing XRP, analyzing market signals, and assessing the future potential of this cryptocurrency.

XRP: Market Trends and Future Prospects

### Current Market Performance of XRP

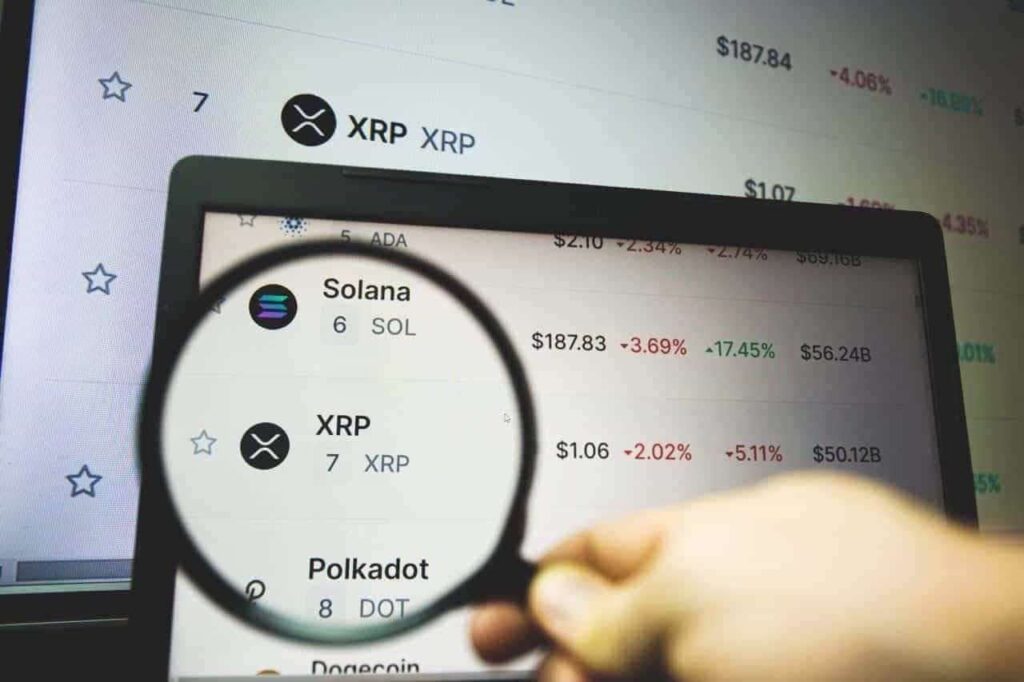

XRP’s performance over the last week reflects a period of consolidation, following a minor rally that piqued the interest of investors. Its market capitalization saw a 4% uptick, indicating a robust presence in the cryptocurrency space. While Zcash (ZEC) posted impressive gains of around 140%, XRP still attempted to carve out its own trajectory.

### Potential Indicators of an XRP Rally

Several technical indicators hint at the possibility of another market surge for XRP. The cryptocurrency is currently maintaining its position within a symmetrical triangle, characterized by a resistance level at $3.20. A breakout beyond this threshold could pave the way for achieving a price of $3.50 or higher.

#### Key Technical Signals

– **Moving Averages**: XRP’s price remains above the 20-day and 50-day simple moving averages, standing at $2.92 and $2.93 respectively—suggesting a bullish outlook.

– **MACD (Moving Average Convergence Divergence)**: The MACD indicator, positioned at 0.00739, further supports the potential for positive momentum.

### Ripple’s Strategic Developments and Their Impact

Ripple, the company behind XRP, is making significant strides that could influence its valuation. In June, Ripple applied for a National Trust Bank charter, a move set to bring its operations under federal oversight by October. Successful approval could integrate XRP more deeply into banking systems, driving an increase in its market value. Conversely, any delays might dampen its price prospects by raising doubts about its adaptability and regulatory compliance.

### Looking Ahead: Strategic Moves and Market Expectations

As Ripple navigates regulatory landscapes with its National Trust Bank initiative, the potential impact on XRP’s market performance remains significant. Investors are closely watching this development, as aligning with regulatory standards could not only enhance Ripple’s credibility but also potentially spur XRP’s upward movement in the market.

### Frequently Asked Questions

What are the implications of Ripple receiving the National Trust Bank charter?

Achieving the National Trust Bank charter would enable Ripple to operate stablecoins under federal supervision, which could enhance XRP’s utility and adoption within financial systems.

How does XRP compare to other cryptocurrencies in terms of recent performance?

While XRP’s recent gains have been modest compared to top performers like Zcash, its substantial market capitalization and potential for regulatory integration maintain its status as a noteworthy contender in the crypto market.

What are the risks associated with investing in XRP now?

Investing in XRP carries typical market risks, such as price volatility and regulatory challenges. Investors should consider these factors alongside technical analyses and market trends when making investment decisions.

In conclusion, this in-depth exploration of XRP provides insights into its current market dynamics, potential future trajectories, and the strategic maneuvers by Ripple that could shape its path forward. As with any investment, staying informed and analyzing market conditions critically is key to making sound financial decisions.