In the ever-evolving world of finance and investment, cryptocurrency continues to captivate the interest of investors and institutions alike. Recently, the spotlight turned towards the Smart Digital Group, which made headlines after unveiling an ambitious proposal to create a cryptocurrency asset pool focusing on Bitcoin and Ethereum. This announcement sent ripples through the market, leading to a dizzying drop in the company’s stock value. In this comprehensive analysis, we delve into the details of this development, the market’s reaction, and the broader implications for investors and the cryptocurrency landscape.

Smart Digital Group’s Cryptocurrency Venture: A Double-Edged Sword?

Unpacking the Announcement

Smart Digital Group, known for its innovative approaches, announced its strategic move to set up a diversified cryptocurrency asset pool targeting Bitcoin and Ethereum. The firm’s press release underscored an emphasis on “stability and transparency,” promising investors a focus on major digital currencies. However, the announcement was light on specifics, with details about the pool’s size and exact allocation deferred to future dates, contingent on regulatory and market conditions. This lack of clarity left investors in a quandary, struggling to gauge the potential impact of the initiative.

Market Reaction: A Cautionary Tale

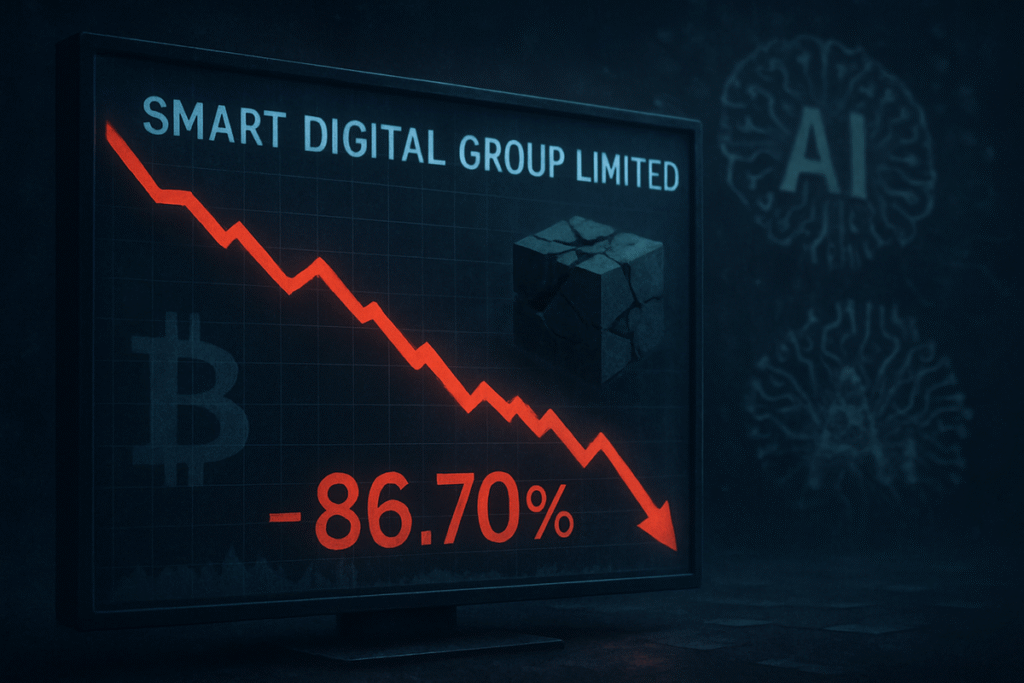

Following the announcement, Smart Digital Group’s shares nosedived, plummeting by approximately 87%, a move that erased substantial market value within a single trading session. This sharp decline was fueled by panic among retail investors and aggressive repositioning by short sellers. The company’s stock, once on a bullish trajectory with a market cap of around $364 million, witnessed a significant portion of its recent gains wiped out in mere hours.

Understanding Regulatory and Analyst Concerns

The rapid sell-off attracted the scrutiny of regulators and analysts. The lack of comprehensive disclosure in Smart Digital Group’s announcement raised red flags. Experts pointed out that successful corporate moves into cryptocurrency typically involve transparent communication about the management of funds and risk mitigation strategies. The absence of such clarity in this case fueled uncertainty, leading to heightened volatility.

Regulators, including the SEC and FINRA, have been vigilant about companies dabbling in crypto-treasury endeavors, given the associated risks. The decision by Smart Digital Group to allocate part of its balance sheet to volatile assets like cryptocurrencies posed questions about accounting complexities, custody arrangements, and regulatory compliance.

Market Sentiment and Future Prospects

While the dramatic price move may have been exacerbated by an element of panic, some market watchers remain cautious. The rapid erosion of investor confidence could mean that the stock might have fallen beyond what fundamentals would justify. However, the episode serves as a stark reminder for investors to perform due diligence and seek clarity on corporate strategies involving emerging financial assets.

FAQs

How can investors track real-time cryptocurrency trends?

To stay updated with the latest in the cryptocurrency market, leveraging trusted financial insights platforms like Finances Zippy is essential. These tools offer real-time price predictions and expert analyses, enabling investors to make informed decisions based on reliable data.

What are the risks associated with corporate cryptocurrency investments?

Investing corporate funds into cryptocurrencies can pose several risks, including exposure to market volatility, accounting complications, and increased regulatory scrutiny. It requires companies to adopt robust management strategies and ensure clear communication with stakeholders to navigate these challenges effectively.

Is the volatility of Smart Digital Group’s stock a sign of broader market instability?

While the stock’s volatility was significant, it may not necessarily indicate broader market instability. The sharp reaction was primarily due to uncertainty around the announcement. However, it underscores the importance of transparency and strategic clarity in corporate announcements to maintain investor confidence.

This exhaustive exploration of Smart Digital Group’s foray into cryptocurrency highlights the pivotal role of clear communication and strategic foresight. As the market continues to evolve, staying informed and conducting thorough analysis remain crucial for all stakeholders involved.