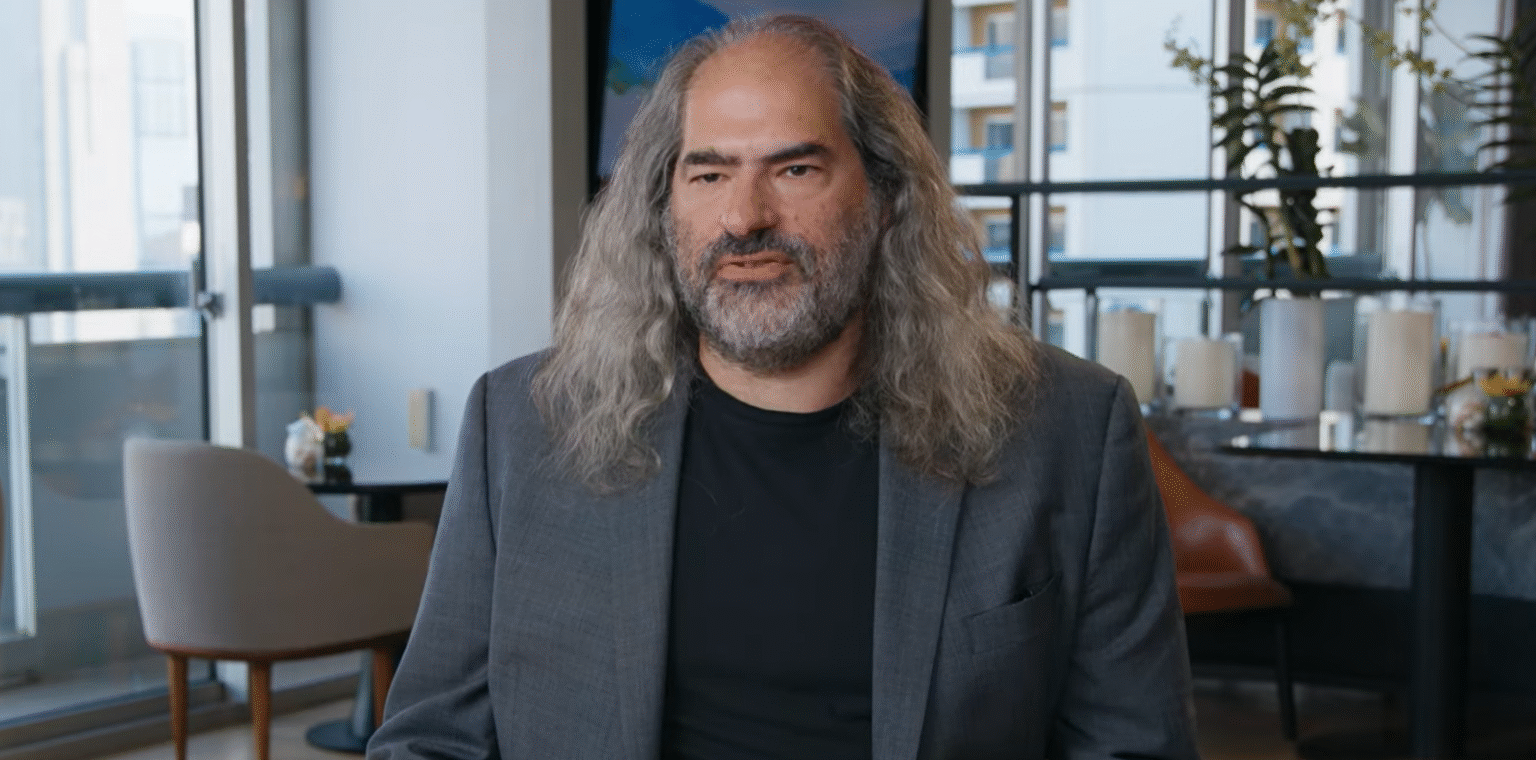

As the world shifts toward digital solutions, the synergy between technology and financial services becomes more pronounced. In this transformative era, blockchain technology emerges as a driving force, offering innovative solutions to longstanding challenges faced by traditional financial systems. The integration of decentralized finance (DeFi) into mainstream operations promises to redefine the landscape, opening doors to unprecedented opportunities for businesses and consumers alike. In his insightful discussion, Ripple’s Chief Technology Officer, David Schwartz, underscores the pivotal role of blockchain in shaping the future of finance—a perspective that aligns with the growing need for efficiency and accessibility in modern financial systems.

The Future of Finance: Blockchain’s Rising Influence

Decentralized Finance Poised to Challenge Traditional Systems

Ripple CTO David Schwartz envisions a future where blockchain technology plays a foundational role in financial services. As he articulates, the demand from tech giants like Amazon and Uber for more comprehensive financial solutions sets the stage for blockchain’s integration, offering programmable money and seamless transactions that current systems struggle to provide. According to Schwartz, the transition isn’t about converting banks to crypto but about meeting the needs of digital-era companies through innovative financial services.

Schwartz critiques the speculative aspects of crypto, urging a focus on practical applications like smart contracts and their surrounding infrastructure. He predicts a significant disruption in traditional finance (TradFi) as DeFi gains traction, provided these new financial systems can deliver reliable services with institutional-level safeguards.

Bridging Decentralization with Institutional Needs

The core of Schwartz’s argument lies in the potential harmony between decentralization and institutional adoption. He posits that institutions value the neutrality offered by public blockchains, which facilitate fair cooperation without central control. This neutrality, he argues, is a strength, not a drawback, allowing diverse stakeholders to engage securely and transparently.

Ripple’s XRPL is strategically positioned to cater to institutional finance needs, offering platforms for stablecoin transactions, tokenized assets, and credit systems, all supported by robust compliance features. Ripple’s analysis highlights XRPL’s strong performance in stablecoin volume, underscoring its potential as a leader in real-world asset exchange.

Earlier initiatives by Ripple, such as proposing a permissioned decentralized exchange (DEX), aim to blend regulatory compliance with the liquidity and openness of public ledgers. This approach reflects Ripple’s vision of regulated entities operating effectively within decentralized environments.

How Does Ripple Plan to Integrate DeFi with Traditional Financial Systems?

Ripple is focusing on creating a bridge between DeFi and traditional finance through platforms like XRPL, which supports stablecoin flows and tokenized assets. This integration is facilitated by compliance tools and neutral governance, ensuring secure and efficient operations.

What Are the Advantages of Decentralized Finance Over Traditional Financial Systems?

Decentralized finance (DeFi) offers numerous advantages, including increased transparency, reduced transaction costs, and enhanced accessibility. It allows for programmable financial services and continuous settlement, which can be particularly beneficial for businesses needing flexible and scalable solutions.

Is Blockchain Neutrality Beneficial for Institutional Adoption?

Yes, blockchain neutrality is crucial for institutional adoption because it provides a reliable foundation for cooperation without a centralized authority. This ensures fair and secure interactions across various parties, enhancing trust and facilitating broader adoption of blockchain technologies in institutional settings.

Delivering content of the highest quality, our editorial process ensures all information is meticulously researched and reviewed by industry experts. This guarantees that our insights are both accurate and valuable, enabling readers to navigate the evolving financial landscape with confidence and clarity.