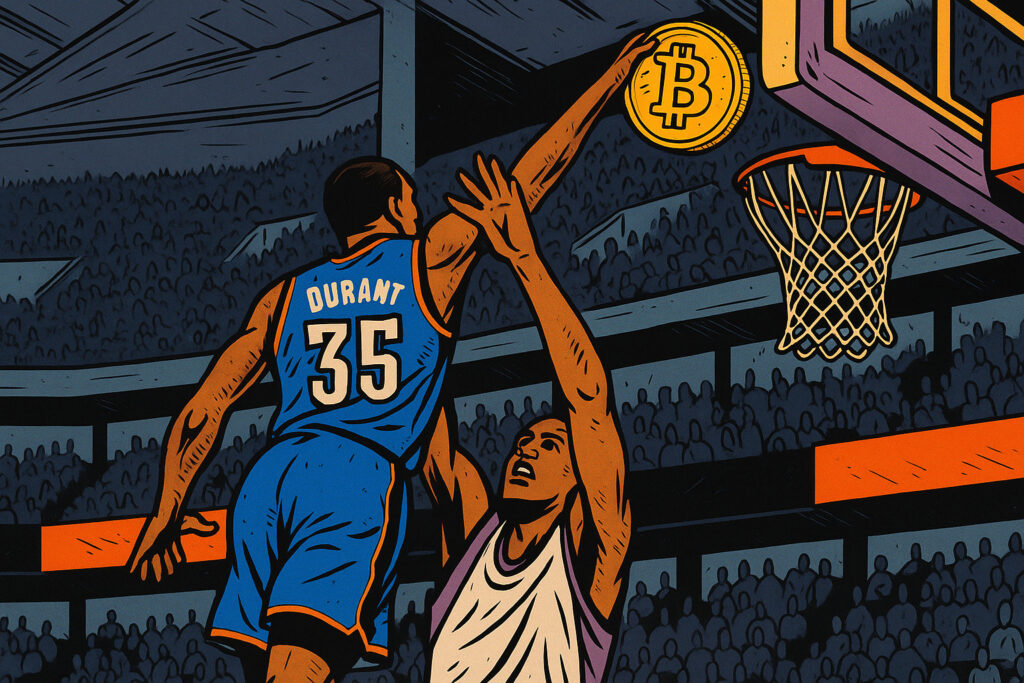

In the fast-paced world of sports and technology, few stories capture the intersection of these two domains quite like that of NBA star Kevin Durant. Renowned for his prowess on the basketball court, Durant’s venture into cryptocurrency has made headlines yet again—not for his performance in the NBA, but for his unexpected windfall from forgotten digital assets. Nearly a decade after acquiring Bitcoin, Durant has regained access to his long-lost Coinbase account, where his holdings have appreciated nearly 200 times in value.

Kevin Durant’s Remarkable Return to Early Bitcoin Investment

Durant’s introduction to Bitcoin came about in 2016 during an unusual encounter at a birthday party hosted by investor Ben Horowitz. His agent, Rich Kleiman, was intrigued by the frequent mentions of “Bitcoin” that night, prompting them to dive into the world of cryptocurrency. This bold move came when Bitcoin was valued at approximately $600. Fast forward to today, and those digital coins are now worth close to $117,000 each. However, Durant faced the hurdle of lost login details, leaving his Coinbase wallet inaccessible for years. Thanks to the assistance of Coinbase’s support team and reset tools, Durant was finally able to reclaim access to his account.

Kevin Durant: Athlete, Investor, and Coinbase Ambassador

Kevin Durant’s association with Coinbase extends beyond personal investment. In 2017, Durant, alongside his agent via their venture capital firm Thirty Five Ventures, invested in the renowned cryptocurrency exchange. By 2021, Durant had become a brand ambassador for Coinbase, aligning his sporting career with the evolving landscape of cryptocurrencies. Following the footsteps of peers like Tristan Thompson, who launched a Web3 project, and Spencer Dinwiddie, who tried to tokenize his NBA contract, Durant exemplifies the growing bond between the sports sector and blockchain technology.

Emergence of Innovative Cryptocurrency Projects

The rediscovery of Durant’s Bitcoin investment underscores the transformative impact of early adoption in the cryptocurrency sphere. Today, alongside traditional Bitcoin, projects that expand upon its potential are gaining ground. A prime example is Bitcoin Hyper, a second-layer solution that combines Bitcoin’s network strength with DeFi features. By integrating the Solana Virtual Machine, it offers swift, cost-effective transactions while incorporating staking mechanisms and decentralized application support.

Bridging Bitcoin with DeFi

Bitcoin Hyper’s standout feature is its Bitcoin Relay, which enables users to shift their BTC to a secondary layer, receiving a representative token in return. This token functions within the Hyper ecosystem, granting access to modern financial services, including yield farming, lending, and decentralized exchanges. The platform facilitates direct fund withdrawals without intermediaries, leveraging zero-knowledge proofs for heightened privacy and scalability.

Staking Flexibility

Bitcoin Hyper addresses common investor concerns over complicated staking processes that require funds to be locked for set durations. Here, staking rewards accumulate automatically from the purchase point, with funds available for withdrawal at any time. This user-friendly approach is ideal for newcomers to cryptocurrency, much like Durant’s initial foray into Bitcoin in 2016. Understanding and capitalizing on such technology does not demand expertise.

Ensuring Security and Transparency

Security is paramount for any emerging cryptocurrency project. Bitcoin Hyper has undergone an audit by Coinsult, which identified no vulnerabilities or supply manipulation mechanisms. This commitment to transparency and security differentiates Hyper from many memecoins that prioritize marketing over substance. Its open-market principles and technological advancements make it an attractive proposition for investors seeking sustainable projects.

Future Prospects and Ecosystem Expansion

The Bitcoin Hyper whitepaper outlines a phased development plan, starting with the launch of the Layer 2 solution and staking capabilities, followed by interoperability with other chains like Polygon and Arbitrum. Several functionalities, including BTC bridging, staking, and basic DeFi applications, are already operational. The project aims to become a Web3 cornerstone, linking various blockchain communities through its ERC-20 and BEP-20 compatibility.

Sports and Blockchain: A New Era

Kevin Durant’s journey in the cryptocurrency realm highlights the potential for technological advancements to alter the financial landscapes of individuals outside traditional finance. An impromptu conversation led to an investment that ultimately proved to be highly lucrative. Recovering access to his Coinbase account illustrates the rewards of patience and openness to innovative solutions.

Simultaneously, the launch of projects like Bitcoin Hyper shows that the cryptocurrency market is evolving rapidly. While Bitcoin remains a symbol of stability and digital gold, the advent of second-layer networks offering fast transactions, staking, and DeFi integration creates new investment opportunities appealing to both seasoned investors and newcomers.

Is Fantom (FTM) a good long-term investment?

Fantom (FTM) has garnered attention for its scalable architecture and low transaction fees. However, as with any investment, one must carefully evaluate market trends, development progress, and competitive positioning to determine its long-term potential.

How can I securely manage my cryptocurrency investments?

Ensuring the security of your cryptocurrency investments involves using reputable wallets like MetaMask or Trust Wallet, enabling two-factor authentication, and keeping track of your private keys and recovery phrases. Additionally, staying informed through platforms like Finances Zippy can provide expert insights and real-time updates.

What factors should I consider when choosing a DeFi project?

When selecting a DeFi project, consider aspects such as the project’s security audit status, transparency of the development team, the utility of the token within its ecosystem, and user feedback. Also, evaluate the project’s partnerships and innovations relative to its competitors.