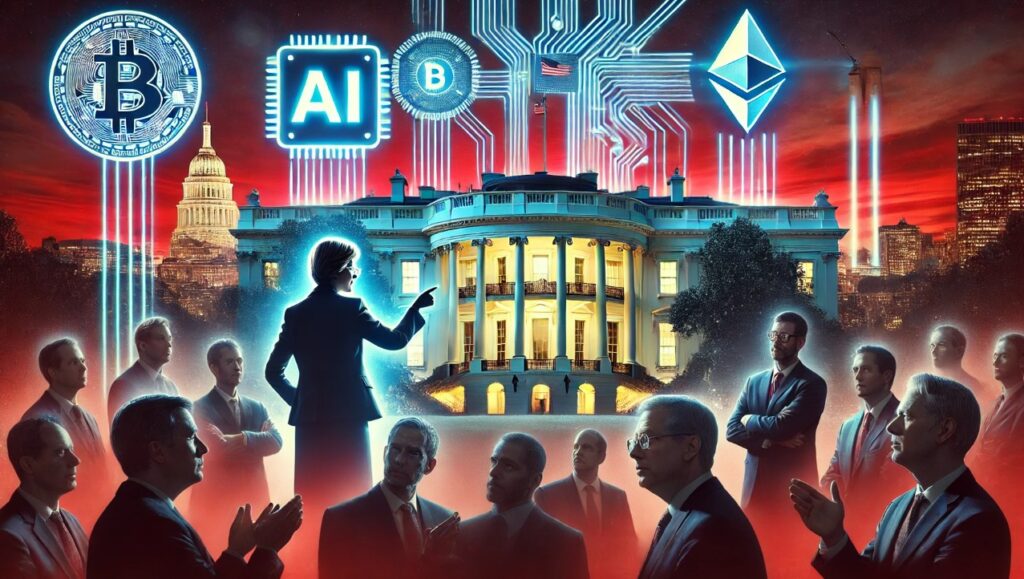

In an era where cryptocurrency and artificial intelligence are reshaping industries, the governance and oversight of these transformative technologies have never been more pivotal. The appointment of venture capitalist David Sacks by the Trump administration to spearhead AI and cryptocurrency initiatives has sparked increased scrutiny concerning his adherence to ethical guidelines. With the rapid advancement of digital currencies and AI, understanding the dynamics of leadership and policy development within such a crucial sector is essential.

Ethical Challenges in Crypto and AI Oversight: The Case of David Sacks

As the digital economy burgeons, so too does the significance of ensuring ethical compliance and transparency among those who influence its trajectory. David Sacks, a notable figure in venture capitalism, assumed the role of AI and cryptocurrency czar, raising questions about the duration and oversight of his engagement. Appointed in January, Sacks faces allegations of potentially overstaying the 130-day limit that applies to special government employees (SGEs), sparking inquiries from prominent Democratic lawmakers including Elizabeth Warren and Melanie Stansbury.

Inquiry into Sacks’ Compliance with SGE Regulations

Democratic leaders have sought a comprehensive account of Sacks’ activities since his appointment. Their concerns center on understanding his operational base and the mechanisms in place to monitor his adherence to SGE regulations. Exceeding the designated period may pose significant ethical dilemmas, especially amidst ongoing legislative developments in the cryptocurrency sector.

The lawmakers emphasize the criticality of clarity and ethical conduct as the Trump administration navigates cryptocurrency policies and regulatory frameworks. Despite these regulatory pressures, Sacks has effectively managed his responsibilities between Washington D.C. and Silicon Valley, strategically avoiding the breach of his term limits.

Criticisms Surrounding Trump’s Cryptocurrency Initiatives

The debate doesn’t stop at Sacks’ personal adherence to regulations. Democratic figures, bolstered by colleagues like Bernie Sanders and Senators Richard Blumenthal and Chris Van Hollen, are vocal about the potential conflicts in the Trump administration’s cryptocurrency ventures. The scrutiny extends to the financial gains of the Trump family from ventures such as the World Liberty Financial (WLFI) token, which recently debuted in trading, allegedly boosting the family’s wealth significantly.

Senator Warren challenges the legitimacy of these financial maneuvers, labeling them as corrupt due to perceived insufficient regulatory scrutiny. Her criticisms highlight the Trump family’s broader engagement in cryptocurrency, including initiatives like American Bitcoin (ABTC) and World Liberty Financial, which spotlight the ongoing tussle over proper oversight.

The dynamics unveiled in these discussions are instrumental in understanding the future of cryptocurrency governance, emphasizing the importance of ethical guidance and regulatory compliance for industry leaders.

Why is Sacks’ Role Under Scrutiny?

David Sacks has faced scrutiny due to concerns over potentially exceeding the stipulated service duration for special government employees. Lawmakers demand transparency about his work scope and compliance oversight, particularly in light of his influence on critical policies.

What Are the Implications of Exceeding SGE Time Limits?

Exceeding the service duration can raise significant ethical issues, potentially undermining public trust and the integrity of the regulatory processes. It emphasizes the importance of adhering to established guidelines to preserve transparency and accountability in government appointments.

How Does This Situation Affect Future Cryptocurrency Regulations?

The ongoing scrutiny highlights the need for robust regulatory frameworks within the cryptocurrency space. It underscores the importance of ethical leadership and could influence future policies to ensure greater oversight and transparency.