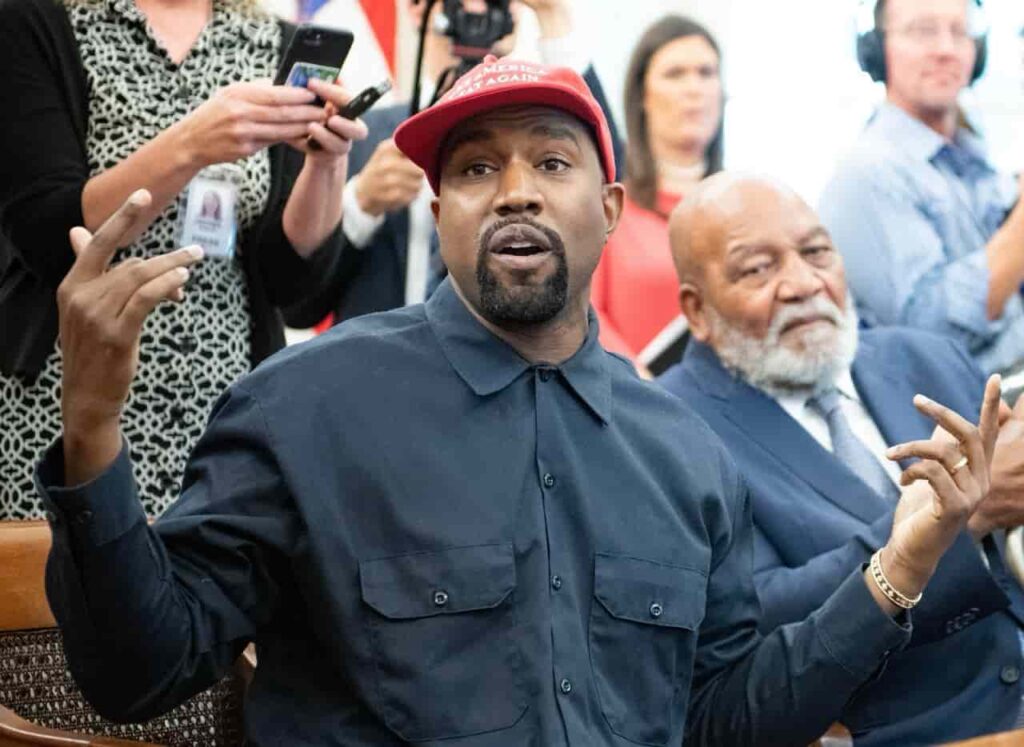

In the ever-evolving world of cryptocurrencies, stories of dramatic gains and losses capture attention and stir curiosity. The recent rise and fall of Yeezy Money (YZY), a memecoin linked to Kanye West, exemplifies the volatile nature of digital assets. As traders navigate this unpredictable landscape, understanding market dynamics and making strategic decisions becomes paramount. This narrative highlights the trials faced by one investor, while shedding light on the speculative frenzy surrounding YZY.

The Risks and Rewards of Trading Yeezy Money Memecoin

In recent developments, the meme-inspired cryptocurrency Yeezy Money (YZY) has captured the attention of traders and speculators alike. Within a short span of time, this token became a topic of interest, thanks in part to its association with celebrity Kanye West, adding a layer of intrigue and risk to its already volatile nature.

The Perils of Volatile Markets

On-chain data brought to light a cautionary tale involving a trader, known by the wallet identifier 6ZFnRH, who faced a hefty loss amid YZY’s tumultuous price movements. Initially, this trader invested 1.55 million USDC to acquire 996,453 YZY tokens, entering the market at an average price of $1.56 per token. Unfortunately, as market conditions shifted and liquidity waned, the price of YZY plummeted below the $1 mark. The trader decided to cut losses at $1.06 per token, recovering only 1.05 million USDC and incurring a loss of $500,000 in a matter of hours.

Continued Interest Despite Setbacks

Despite such high-stakes losses, the allure of YZY remains strong among daring speculators. Notably, a recognized trader, Machi Big Brother (@machibigbrother), has boldly taken a 3x leveraged long position, involving 570,000 YZY valued at $613,800. This indicates a belief in capitalizing on the coin’s volatility for potentially significant returns.

Kanye West’s Strategic Moves

Adding to the intrigue, Kanye West himself has actively engaged with the YZY market. Recent blockchain records reveal that he contributed 30 million YZY, equivalent to $34 million, into a liquidity pool hosted on the Meteora platform. This move sets an automated trading range between $3.1716 and $4.4929, with mechanisms in place to earn fees should YZY’s price cross these thresholds. A breach below the lower limit allows West to accumulate returns, while surpassing the upper boundary triggers the sale of his entire allocation, potentially reaching a valuation of $134 million.

The Future of Yeezy Money

As reports continue to surface about whale losses, leverage strategies, and celebrity interventions, the atmosphere around YZY remains electric. However, with the token currently trading below $1, skepticism about its long-term viability is growing. The combination of high-profile involvement and extreme market dynamics underscores the importance of caution and insight for those participating in such speculative ventures.

Are there significant risks associated with investing in memecoins like Yeezy Money?

Yes, investing in memecoins carries substantial risks due to their volatile nature and speculative appeal. Prices can swing dramatically based on market sentiment, influencer involvement, and broader cryptocurrency trends, leading to potential losses or gains. Thorough research and risk assessment are vital before investing in such assets.

How do celebrity endorsements impact the value of a cryptocurrency like Yeezy Money?

Celebrity endorsements can significantly influence cryptocurrency value, often increasing market interest and driving up prices temporarily. However, this can also lead to high volatility, as reliance on celebrity influence rather than fundamental value can result in drastic price fluctuations.

What factors should I consider before investing in a volatile cryptocurrency?

When considering investments in volatile cryptocurrencies, evaluate the technology behind the coin, market trends, liquidity, and the credibility of developers and backers. Diversifying investments and setting clear entry and exit strategies can help manage risk and secure profit.

This comprehensive guide to Yeezy Money delves into the intricacies of its market behavior, offering insights into the forces driving its fluctuating value. By understanding the dynamics at play, investors can make informed decisions in the unpredictable world of digital currencies.