In the rapidly evolving world of cryptocurrency, understanding market trends and investor behaviors is crucial to making informed decisions. Recent market activity surrounding Bitcoin has attracted attention, highlighting shifts in the behavior of various investor groups. As Bitcoin’s price fluctuates, distinct patterns emerge among different cohorts, revealing insights into their investment strategies and reactions to market conditions. Let’s explore the dynamics at play in the Bitcoin market and how investors are responding to recent price movements.

Investor Behavior and Market Reactions: Insights from Bitcoin’s Recent Price Fluctuations

Understanding the Actions of Bitcoin Investor Cohorts

Recent analysis from the financial insights platform Glassnode has shed light on how different Bitcoin investor groups have reacted to the latest price decrease. By categorizing investors into specific cohorts, Glassnode provides valuable insights into market behavior, aiding investors in navigating the complex cryptocurrency landscape.

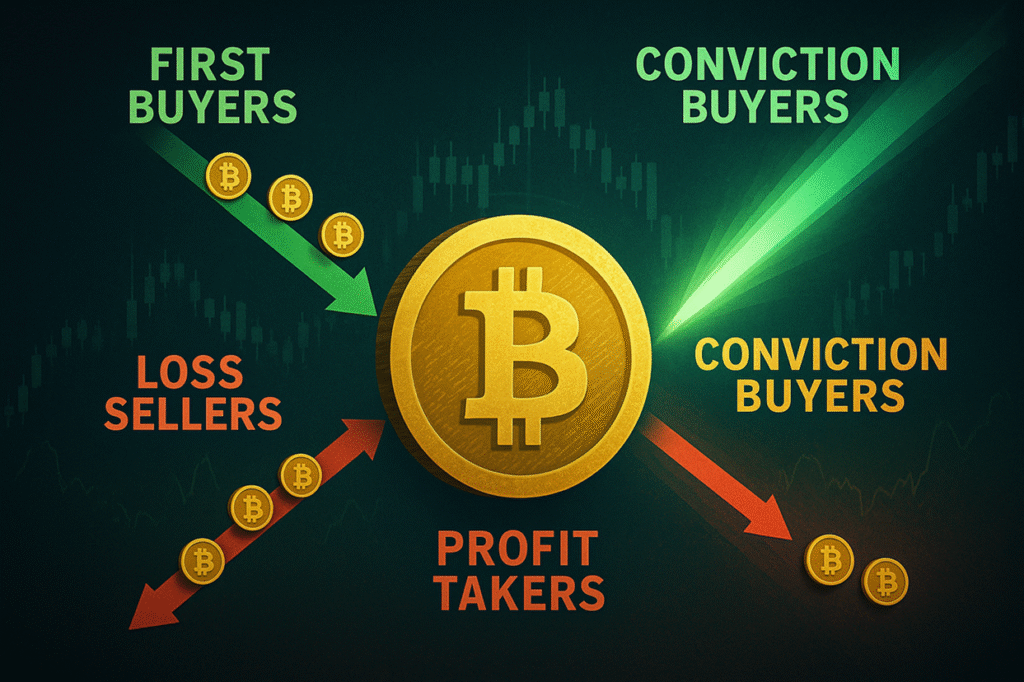

One group of interest is the “First Buyers,” or those acquiring Bitcoin for the first time. Recent data shows an increase in their holdings from 4.88 million BTC to 4.93 million BTC over the last five days, indicating fresh demand entering the market amid the price dip. Although this change represents only a 1% rise, it highlights renewed interest among new investors.

Another pivotal group, the Conviction Buyers, are known for purchasing Bitcoin during price downturns. This cohort has increased its holdings by 10.1%, growing from 0.93 million BTC to 1.03 million BTC. While this is a significant uptick, it remains more subdued compared to previous surges, suggesting that either the dip is not deep enough for strategic purchases or caution persists among investors.

Market Reactions: Panic Selling and Profit Taking

Price declines often trigger varied reactions among investors, including panic selling. The “Loss Sellers” group, which represents those selling at a loss, saw a 37.8% increase in activity over the past five days, growing from 63,000 BTC to 87,000 BTC. Despite this rise, realized losses remain relatively controlled compared to earlier in the year, indicating limited panic among investors.

Conversely, the “Profit Takers” have emerged as dominant sellers during this period, with their supply increasing by 5.4%—the highest spike observed in 2023. This suggests that some investors have seized the opportunity to lock in gains and exit the market.

Current Bitcoin Price Landscape

In recent days, Bitcoin has experienced a notable decline, with its value dropping to $113,100. This downward trend reflects broader market volatility, emphasizing the importance of understanding investor behavior as it can significantly impact price movements.

Frequently Asked Questions

What factors influence Bitcoin investor behavior during price dips?

Investor behavior during price dips is influenced by a variety of factors, including market sentiment, individual risk tolerance, and broader economic conditions. Some investors may see dips as buying opportunities, while others view them as a reason to sell to mitigate potential losses. Additionally, media coverage and technical indicators play significant roles in shaping investor reactions.

Is the current Bitcoin price decline a buying opportunity?

Assessing whether the current Bitcoin price decline represents a buying opportunity requires careful consideration of market conditions, individual investment goals, and risk tolerance. While some investors see dips as favorable entry points, it’s essential to conduct thorough research and consider market trends and historical performance before making investment decisions.

How do Conviction Buyers influence Bitcoin price trends?

Conviction Buyers can impact Bitcoin price trends by increasing demand during price downturns. Their purchasing activity often supports price stabilization and can signal confidence in the asset’s long-term value. However, their influence varies depending on market conditions and the overall volume of buying activity relative to selling pressure.

This comprehensive exploration of Bitcoin’s current market dynamics provides a detailed analysis of investor behaviors and their potential implications for future price trends, empowering readers with the knowledge needed to navigate the ever-changing cryptocurrency landscape.