In a world where financial security is of utmost importance, the addition of cryptocurrencies to retirement portfolios could redefine conventional savings plans. Recent developments suggest that the landscape of retirement investments might soon see a transformative shift, thanks to potential regulatory changes. Let’s delve into how this evolution is unfolding and the challenges it brings.

The Integration of Cryptocurrencies in Retirement Plans: A New Era

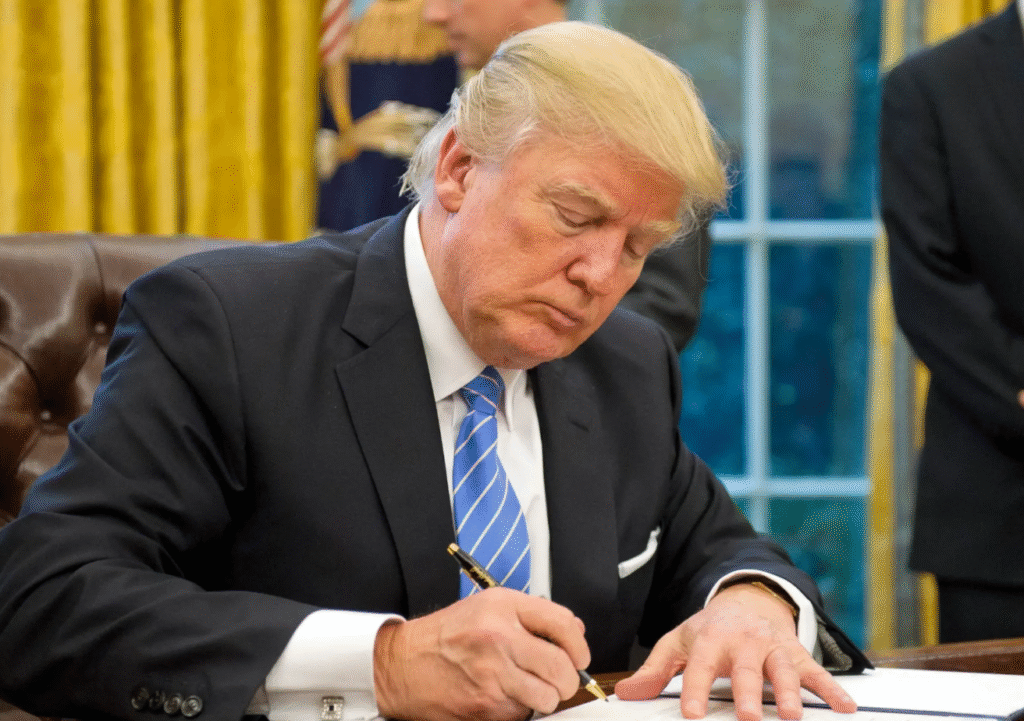

Cryptocurrency has taken center stage in financial conversations, and its potential inclusion in retirement plans could significantly alter how individuals save for their future. As reported by financial expert Mike Novogratz, a strategic order from former U.S. President Donald Trump aims to simplify the incorporation of digital currencies into pension plans. With Americans holding approximately $8.7 trillion in 401(k) plans, even a slight cryptocurrency allocation could have a profound impact.

Novogratz highlighted that if investment giants like Fidelity, BlackRock, or T. Rowe Price incorporate digital assets into their retirement offerings, we could see a notable increase in cryptocurrency adoption. This would allow everyday savers to leverage tax benefits within their pension schemes while investing in digital assets. However, plan sponsors and managers must still adhere to ERISA rules, ensuring they act prudently and in the participants’ best interests.

The rise of cryptocurrencies, known for their volatility, introduces substantial legal and compliance risks. Despite the promising executive order, financial regulators and pension plan managers must navigate numerous practical and regulatory hurdles before cryptocurrencies can be a stable component of retirement portfolios.

Overcoming Fiduciary and Operational Challenges

Integrating cryptocurrencies into defined contribution retirement plans like 401(k)s requires addressing several key operational challenges. Administrators need reliable solutions for asset custody, transparent tracking, and the development of low-cost products. Many cryptocurrencies are currently tied to investment vehicles with lock-up periods or high fees, mismatches with the liquidity, transparency, and cost efficiency expected in 401(k) structures.

Moreover, there’s a real risk of legal action: should the value of cryptocurrency investments plummet, participants could contest fiduciary decisions, potentially leading to legal proceedings. Regulators face the challenge of balancing investor protection against the need to provide access to innovative financial instruments like cryptocurrencies. Asset managers must also carefully assess market demand while mitigating legal and regulatory risks.

Recent market movements underscore the impact of this news: Bitcoin has surged to $116,800, marking a 3.0% increase in the last 24 hours, while Ethereum has risen by over 6%, reaching $3,900, as per Finances Zippy.

Citing the BlackRock Bitcoin Trust as an example, Novogratz pointed to the growing demand for crypto exposure through institutional products. These instruments offer a regulated and familiar entry point for both institutional and retail investors.

A Phased Implementation

An immediate, widespread adoption isn’t expected. Major portfolio managers are likely to start with pilot projects focusing on custody and compliance before extending broader access to investors. Pension plan managers might begin with small, optional allocations or offer specialized cryptocurrency-related services rather than immediately integrating them into default funds. Even modest percentages across numerous accounts can lead to substantial capital flows over time.

In summary, Novogratz’s remarks, alongside emerging reports, indicate that the executive order signals a strong political push. Once fully endorsed, it could gradually channel more retirement capital towards cryptocurrencies.

What are the potential benefits of including cryptocurrencies in retirement plans?

Incorporating cryptocurrencies into retirement plans could offer diversification benefits and the potential for significant returns. However, the inherent volatility requires careful consideration and balanced allocations to manage risk effectively.

Are cryptocurrencies safe for retirement investments?

While cryptocurrencies present lucrative opportunities, they are also highly volatile and can pose risks. It is crucial for investors to conduct thorough research and seek professional advice when considering digital assets for retirement portfolios.

How can regulations impact the integration of cryptocurrencies in 401(k) plans?

Regulatory frameworks ensure the security and compliance of retirement plans. The integration of cryptocurrencies requires adherence to ERISA guidelines, focusing on prudent management and participant interests, which can influence how and when these digital assets are incorporated.

This comprehensive guide delves into the intricacies of integrating cryptocurrencies into retirement funds, highlighting the potential benefits and challenges. The FAQs aim to equip investors with insights, enabling them to make informed decisions in this evolving financial landscape.