The evolving landscape of cryptocurrency mining in Russia presents a fascinating case of technological advancement and regulatory adaptation. In recent years, the Russian government has made significant strides in transforming the once shadowy world of crypto mining into a legitimate and regulated industry. This shift not only underscores the country’s growing influence in the global crypto market but also highlights the economic potential that regulation can unlock. As we delve deeper into this topic, you will gain insights into how Russia’s strategic approach is reshaping the crypto mining sector and its broader implications for the technological and economic landscape.

The Transformation of Russia’s Crypto Mining Industry

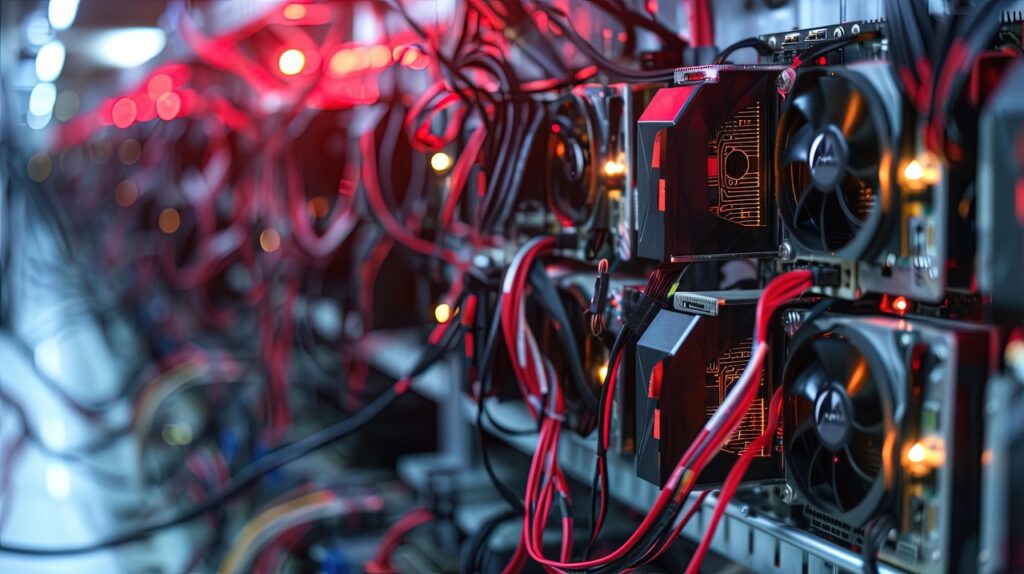

A Surge in Registered Crypto Mining Companies

The number of officially registered cryptocurrency mining businesses in Russia has skyrocketed from a modest 91 at the beginning of 2024 to over 1,000 today. This dramatic increase follows the introduction of a stringent law requiring entities consuming more than 6,000 kWh of electricity monthly to register with the Federal Tax Service (FTS). As a result, the prevalence of officially recognized “white” miners now vastly outnumbers those operating under the radar.

The new regulations mandate that registered firms disclose the volume of cryptocurrencies they mine and the digital wallets holding these assets. This measure not only facilitates tax collection on mining profits but also promises to channel substantial revenue into Russia’s national treasury. According to industry estimates, these developments could bolster state finances by as much as $500 million annually.

Managing Grid Overloads: A Historical Perspective

Prior to the implementation of mandatory registration, many crypto miners operated in secrecy to avoid penalties or shutdowns. This clandestine activity often led to power grid overloads, causing unexpected blackouts in certain regions. However, these issues are becoming increasingly rare as formal registration practices enable better management of electricity consumption across the country.

Investments Beyond Traditional Mining

Russian industrial miners are diversifying their investments beyond conventional ASIC setups, channeling over $60 million into artificial intelligence (AI) projects this year alone. This shift in investment strategy underscores a broader vision whereby cryptocurrency is integrated into a comprehensive technological framework rather than existing as an isolated sector. By retaining more tech capital within the country, Russia is positioning itself as a hub for innovation.

A Closer Look at Bitcoin Hashrate

The Association of Industrial Miners reports that Russia now accounts for over 150 EH/s, equivalent to nearly 17% of the world’s Bitcoin hashrate, placing it second globally after the United States. Domestically, it is estimated that Russia’s Bitcoin production reached up to 40,000 BTC in 2024, valued at approximately $4.8 billion at current prices. This remarkable growth highlights the positive impact that a clear regulatory environment can have on the crypto sector.

Legal Approaches to Combat Unregistered Mining

In a bid to further combat illicit mining activities, Russian policymakers are advocating for legislative changes to classify cryptocurrency as “intangible property.” This legal adjustment would empower courts to seize crypto assets from illegal miners, thus tightening regulations around any remaining unregistered operations. By prioritizing regulation over prohibition, Russia aims to maintain grid stability, ensure fiscal accountability, and foster technological development.

FAQs on Russian Crypto Mining

Why has the number of registered crypto mining companies increased in Russia?

The surge in registered crypto mining firms is primarily due to new legislation requiring entities consuming significant electricity for mining to register with the Federal Tax Service (FTS). This regulation ensures legal compliance and facilitates tax collection on mining profits.

What impact does regulation have on Russia’s crypto mining industry?

Regulation has brought transparency to the crypto mining industry, allowing better management of resources and increasing state revenue through taxes. It also supports stable power usage, preventing the grid overloads experienced in the past.

How is Russia’s investment in AI related to crypto mining?

Russia’s investment in AI reflects a strategic effort to integrate cryptocurrency within a broader technological and economic framework. By investing in AI, the country enhances its innovation capabilities, ensuring that technological advancements are leveraged across different sectors.

In conclusion, Russia’s approach to cryptocurrency mining demonstrates the potential for regulatory frameworks to enhance industry growth. With increased registration, strategic investments, and a focus on legal compliance, Russia is setting a precedent that other nations might follow as the global crypto market continues to evolve.