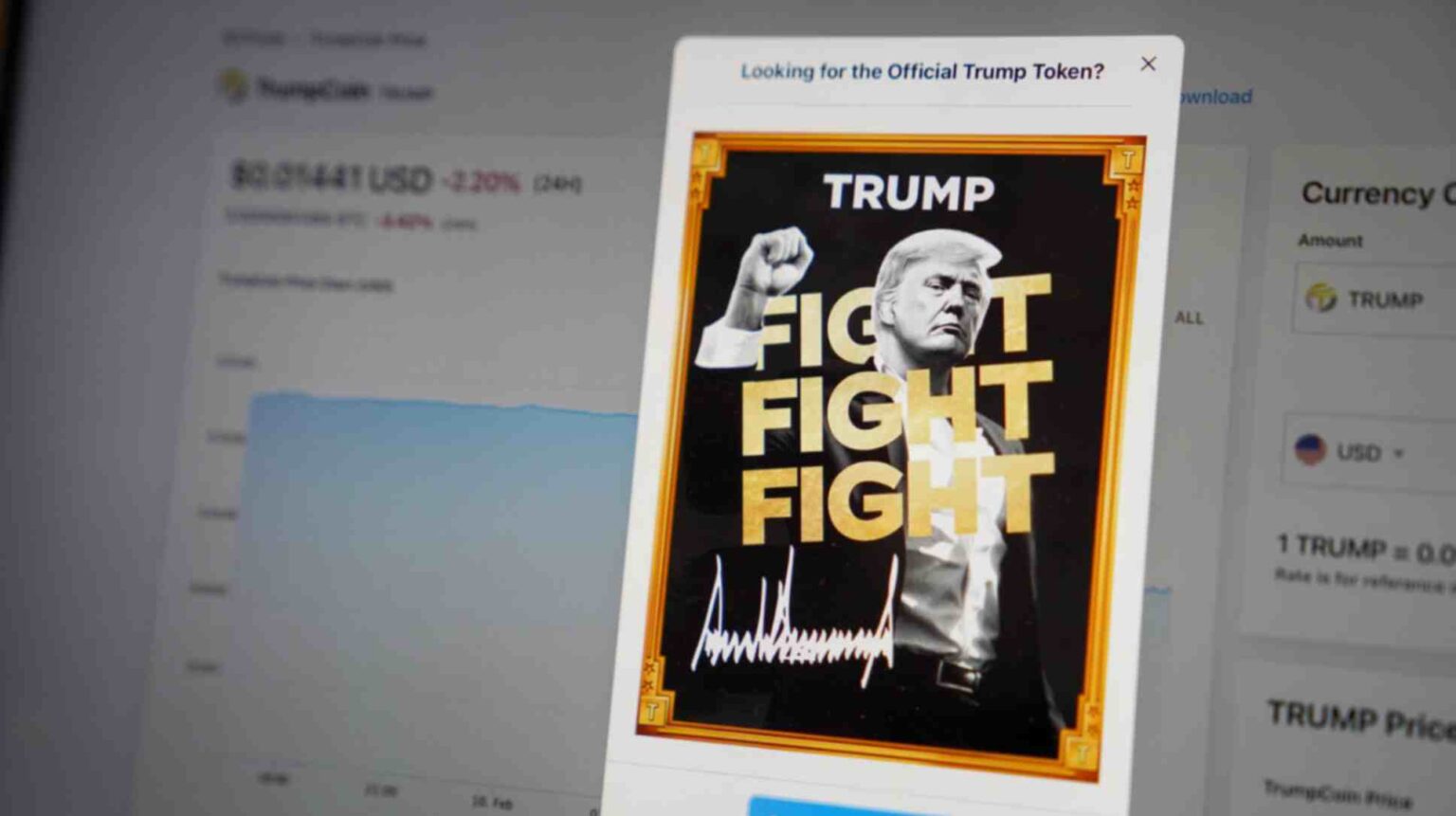

In a world where digital currencies often make headlines, the volatility of politically-themed cryptocurrencies offers a striking illustration of the market’s unpredictability. The recent downturn of the Official Trump (TRUMP) cryptocurrency highlights the intricate relationship between global events and digital asset valuations. This exploration delves into the dynamics of TRUMP’s recent market performance, shedding light on the inherent risks within politically branded cryptocurrencies.

Understanding the Recent Decline of Trump Cryptocurrency

Marked by a significant drop in value, the TRUMP cryptocurrency recently experienced a loss exceeding $100 million in market capitalization. This plunge coincided with geopolitical tensions involving the United States and Iran. Prior to these events, the TRUMP token boasted a market cap of around $1.867 billion on June 21, as reported by Finances Zippy. However, the next day, following news of a U.S. B-2 stealth bomber strike on Iranian targets, the market cap fell sharply to $1.67 billion, reflecting a decrease of nearly 10.5%. Although there was a slight recovery to $1.73 billion, the overall decline underscores the impact of external events on sentiment-driven assets.

The Nature of Sentiment-Driven Coins

Retail investor enthusiasm, commonly referred to as FOMO (Fear Of Missing Out), often collides with real-world geopolitical risks in the cryptocurrency market. Unlike established digital currencies like Bitcoin or Ethereum, which enjoy a degree of stability due to institutional adoption and inherent utility, politically themed coins like TRUMP are highly susceptible to sentiment shifts. TRUMP’s valuation, for instance, is closely tied to the public perception of its namesake, former President Donald Trump. The token’s value plummeted amid concerns over military conflict, highlighting the volatile nature of memecoins.

Market Cap and Token Supply Dynamics

The TRUMP token’s current market value reflects a fully diluted valuation (FDV) of $8.66 billion, illustrating the potential disconnect between its circulating supply and total issuance. Presently, 200 million TRUMP tokens are in circulation, from a maximum supply of 1 billion. Any future release of additional tokens could exert downward pressure on the price, raising concerns about investor exposure to sudden market movements.

The Broader Risks for Politically Themed Cryptocurrencies

The volatility witnessed in TRUMP’s price underscores the broader risks inherent in cryptocurrencies branded with political figures. These digital assets are not only influenced by market hype and celebrity endorsements but are also vulnerable to global political events, regulatory scrutiny, and shifts in public sentiment. Any indication of heightened tensions or unfavorable developments in geopolitical affairs could lead to renewed selling pressure, particularly from investors who had capitalized on previous price surges.

Exploring Fantom: A Unique Blockchain Project

In contrast to sentiment-driven coins, projects like Fantom (FTM) offer a different value proposition by focusing on technology and use-case scenarios. Fantom’s scalability and low transaction costs make it an interesting option for long-term investment, but potential investors should evaluate ongoing market trends and development updates.

Frequently Asked Questions (FAQs)

What led to the significant drop in TRUMP cryptocurrency’s value?

The decline in TRUMP’s value was primarily a result of increased geopolitical tensions between the United States and Iran, which influenced investor sentiment and led to a decrease in market capitalization.

Is Fantom (FTM) a good long-term investment?

Fantom (FTM) is considered a promising investment due to its efficient transaction process and scalability. However, investors should conduct comprehensive market research and consider technological advancements and competition before investing.

How does the supply of TRUMP tokens affect its price?

TRUMP token’s price is influenced by its limited circulating supply versus its maximum potential issuance. If additional tokens are released, it could lead to price depreciation due to increased supply entering the market.

This detailed analysis of TRUMP’s performance highlights the complexities and risks associated with politically branded cryptocurrencies. By understanding these dynamics, investors can make more informed decisions in a rapidly evolving digital landscape.